The Volkswagen Group (which includes Volkswagen, Audi, Porsche, Skoda, Seat, Cupra, and more) reported 2,331,500 global vehicle sales during the second quarter of 2023 (up 18 percent year-over-year). The relatively strong rebound in Q2 allowed VW to achieve 4,372,200 units sold in the first half of the year, which is a 12.8 percent improvement over H1 2022.

Let’s now take a look at battery-electric vehicle (BEV) sales, which are increasing even faster than general sales.

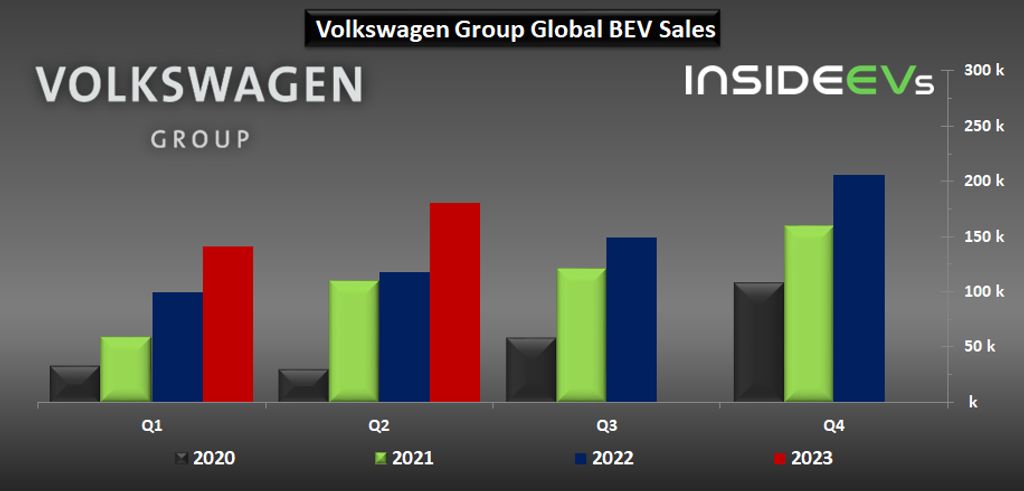

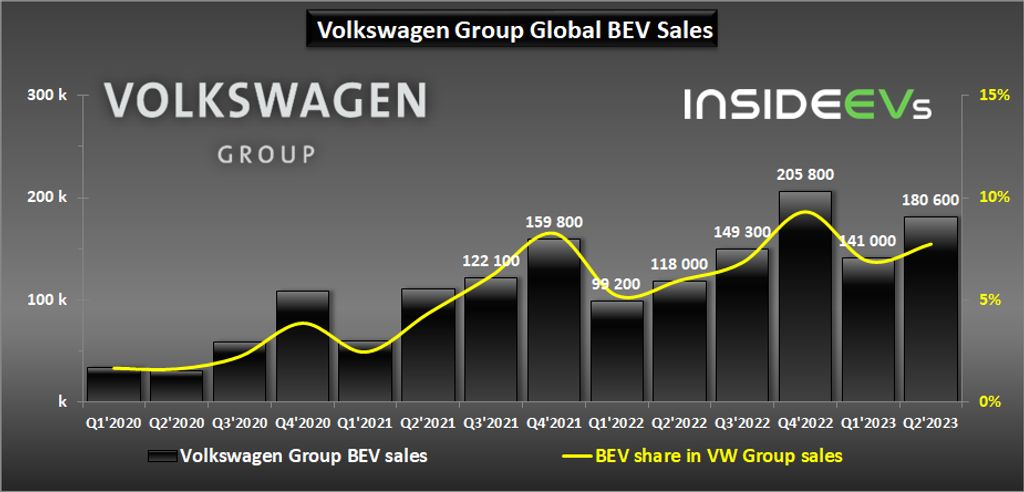

In Q2, Volkswagen Group’s all-electric vehicle sales amounted to about 180,600 (up 53 percent year-over-year), which was 7.7 percent of the total volume (compared to 6.0 percent a year ago).

Without a doubt, it was the second-best quarter in terms of BEV sales so far, although from a broader perspective, it still does not appear satisfying – especially because the group had much higher aspirations a few years ago, even talking about overtaking Tesla.

Volkswagen Group BEV sales in Q1 2023:

- Total: 180,600 (up 53% year-over-year) and 7.7% share

During the first half of the year, the group sold more than 321,000 all-electric vehicles around the world. The growth rate is about 48 percent year-over-year, while the BEV share in the total volume is estimated at 7.4 percent.

Volkswagen Group BEV sales in Q1-Q2 2023:

- Total: 321,600 (up 48% year-over-year) and 7.4% share

For reference, in 2022, Volkswagen Group sold about 572,100 all-electric vehicles around the world (up 26 percent year-over-year), which was 6.9 percent of the total volume.

We are pretty sure that 2023 will be a record year for the Volkswagen Group, but our initial guess that 0.9-1.0 million units are possible, potentially was too optimistic.

Hildegard Wortmann, member of the Group’s Extended Executive Committee for Sales said:

“With an increase in all-electric deliveries of around 50 per cent in the first half of the year, the Volkswagen Group is systematically continuing its transformation. We are the market leader in Europe in this segment and have gained market share. Since May, we have again seen an improved trend in incoming orders here, after a certain reluctance on the part of our customers at the start of the year due to reduced subsidy programs, partly long waiting times and high inflation. In view of the recent significant reduction in delivery times, we expect this positive trend to continue in the coming months.”

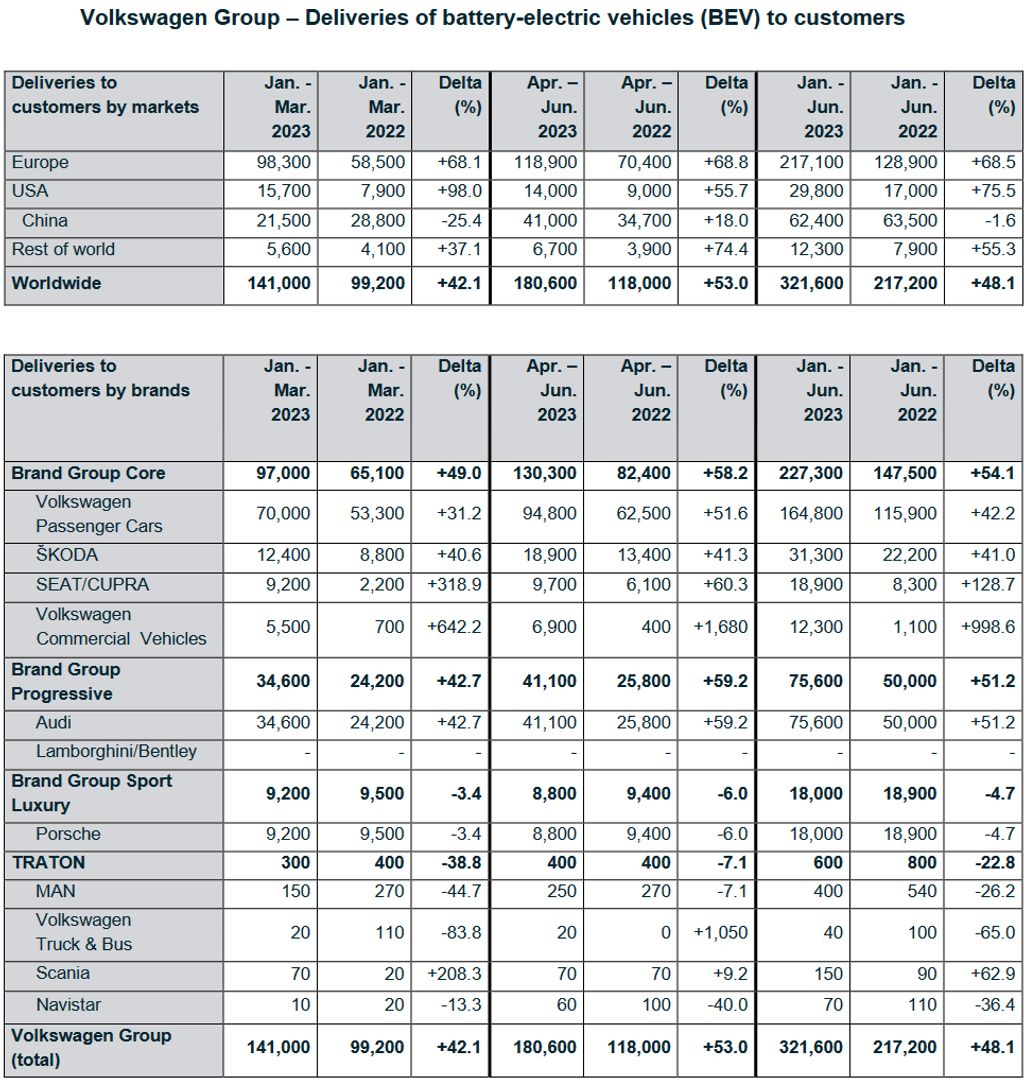

Just like in the previous periods, Europe remains the largest BEV market for the Volkswagen Group (118,900 units in Q2), with a share of about two-thirds. BEV sales growth in Europe (69 percent year-over-year) is also faster than in many other markets.

The Volkswagen Group noted that its order bank in Western Europe alone is at around 200,000 BEVs.

In the United States, sales increase quickly although the volume is significantly lower, and does not play that big of a role.

In China, things started to improve in Q2, but the relatively weak Q1 dragged the first half into the red anyway.

Sales in Q2 2023:

- Europe: 118,900 (up 69%)

- US: 14,000 (up 56%)

- China: 41,000 (up 18%)

- Rest of the world: 6,700 (up 74%)

- Total: 180,600 (up 53% year-over-year)

Sales in Q1-Q2 2023:

- Europe: 217,100 (up 69%)

- US: 29,800 (up 76%)

- China: 62,400 (down 1.6%)

- Rest of the world: 12,300 (up 55%)

- Total: 321,600 (up 48% year-over-year)

The Volkswagen brand (94,800 units) was responsible for around half of all the group’s BEV sales. The second biggest in the BEV segment once again was Audi (41,100). Skoda was the third brand with 18,900 units sold, while all of the other brands/subsidiaries were below 10,000 units in Q2.

We covered each brand separately to better understand what is happening in the industry and links to the individual reports can be found below:

Sales in Q2 2023:

- Volkswagen (cars): 94,800 (up 52%)

- Audi: 41,100 (up 59%)

- Skoda: 18,900 (up 41%)

- Seat/Cupra: 9,700 (up 60%)

- Porsche: 8,839 (down 6%)

- Volkswagen (commercial vehicles): 6,900 (up 1,680%)

- other (MAN, Volkswagen Truck & Bus, Scania, Navistar): 400 (down 7%)

- Total: 180,600 (up 53% year-over-year)

Sales in Q1-Q2 2023:

- Volkswagen (cars): 164,800 (up 42%)

- Audi: 75,600 (up 51%)

- Skoda: 31,300 (up 41%)

- Seat/Cupra: 18,900 (up 129%)

- Porsche: 17,991 (down 5%)

- Volkswagen (commercial vehicles): 12,300 (up 1,100%)

- other (MAN, Volkswagen Truck & Bus, Scania, Navistar): 600 (down 23%)

- Total: 321,600 (up 48% year-over-year)

In Q2, the group’s best-selling electric car, without any surprise, is the Volkswagen ID.4 (counted by the manufacturer together with the ID.5 coupe version) at 59,300 units.

The all-electric Q4 (26,700) also slightly outpaced the Volkswagen ID.3 (26,200), indicating that crossovers/SUVs are more appealing.

Select BEV model sales (for which data are available) in Q2 2023:

- Volkswagen ID.4/ID.5 – 59,300

- Audi Q4 e-tron (incl. Sportback) – 26,700

- Volkswagen ID.3 – 26,200

- Skoda Enyaq iV (incl. Coupé) – 18,900

- Audi e-tron/Q8 e-tron (incl. Sportback) – 9,800

- Cupra Born – 9,700

- Porsche Taycan (all versions) – 8,839

- other models – 21,161

- Total: 180,600 (up 53% year-over-year)

Select BEV model sales (for which data are available) in Q1-Q2 2023:

- Volkswagen ID.4/ID.5 – 101,200

- Volkswagen ID.3 – 49,800

- Audi Q4 e-tron (incl. Sportback) – 48,000

- Skoda Enyaq iV (incl. Coupé) – 31,300

- Audi Q8 e-tron/e-tron (incl. Sportback) – 19,500

- Cupra Born – 18,900

- Porsche Taycan (all versions) – 17,991

- other models – 34,909

- Total: 321,600 (up 48% year-over-year)

Some of the models are very similar and offered by different brands. For example, the MEB-based crossover/SUV – Volkswagen ID.4/ID.5, Audi Q4 e-tron (incl. Sportback) and Skoda Enyaq iV (incl. Coupé) – together noted 104,900 (Q2). That’s more than half of the total volume.

Similarly, the MEB-based compact hatchbacks: Volkswagen ID.3 and Cupra Born, together noted 35,900 units.

This leaves 39,800 units (22 percent) for all other BEVs sold by the Volkswagen Group in Q2 2023.

By the way, it’s worth noting that recently, the group produced its one-millionth MEB-based electric car.