Automotive tool-and-die companies, many of which have struggled financially in the past three years, should soon be in a stronger position as automakers launch more than 130 new electric or hybrid models as well as redesigns for internal combustion mainstays, according to a new study.

Automakers plan to significantly increase spending on tooling in North America ahead of those vehicle arrivals, the study by Harbour Results Inc. and AutoForecast Solutions says.

The study projects automakers’ base tool spending in the region is set to hit $7.1 billion in 2025, up from $5 billion last year.

That’s because the boom in new models is coming.

Those 130 vehicles are expected to launch between now and 2030, with plans to convert or build 56 plants to assemble them in North America, according to the study. All of those projects require new tools and dies and production machinery.

“I’m very bullish about the tool-and-die industry,” said Laurie Harbour, CEO of Harbour Results, which monitors trends among tool-and-die and mold-makers in North America. “If they can get through the balance of this year, they’re going to see a lot of vehicle launches coming.”

The study, “Electrifying Mobility,” delves into the impact of electrification on the North American auto supply chain. Tool-and-die companies are considered a bellwether for the industry.

The sector has been under intense financial pressure brought on by higher costs and supply chain challenges. All the while, tool-and-die companies are attempting to ensure they can win business in the future as the industry electrifies and geopolitics alter where automakers source their parts.

It’s a particularly challenging balance to strike for tool-and-die companies, whose finances are “very strained,” Harbour said.

“They had a few tough years starting in 2020, and it wasn’t pandemic-related,” she said. “It was product development cycle-related.”

Automakers had launched a significant number of key programs in the years leading up to 2020. But tooling orders slowed as fewer new models were launched in the following years. Many companies have also had a tough time recruiting and training enough workers to keep their facilities running.

But there’s hope on the horizon for toolmakers with the coming new vehicles.

“It’s an almost unprecedented number of vehicle launches coming up,” Harbour said. “So with all of that product launching, it’s a very bullish forecast for them. [New products] all require tooling, regardless of how many vehicles [automakers are] going to sell.

Much of the increase in tooling will still be driven by internal combustion engine vehicles, according to the study. Stellantis, for example, is expected to spend $4.6 billion on tooling in North America for such models from 2023 to 2026. That compares with $1 billion for battery-electric vehicles, 90 percent of which is slated for this year.

It’s a similar situation at Toyota, Honda, Nissan and Hyundai. Those four automakers combined are expected to spend $4.4 billion on internal combustion-related tooling in North America from 2023 to 2026, compared with $1.4 billion on BEV tooling, according to the study.

The study’s authors are skeptical of the industry’s most bullish EV projections, which include major automakers vowing to become all-electric at some point next decade. High costs, the need to invest more in charging infrastructure and consumer concerns about range anxiety will keep companies from achieving those targets, Harbour said.

“We just don’t believe it’ll happen at the pace that they say it’s going to,” she said.

Still, more is expected to happen on electrification “in the next 5 to 10 years than has happened in the last 20 years,” according to the report.

Companies throughout the supply chain — particularly smaller suppliers and toolmakers — need to be prepared, Harbour said.

“It’s one thing to ask a Magna if you’ve planned for this. It’s another to ask a $75 million stamper in the automotive space that’s supplying Magna if they’ve thought about this,” she said.

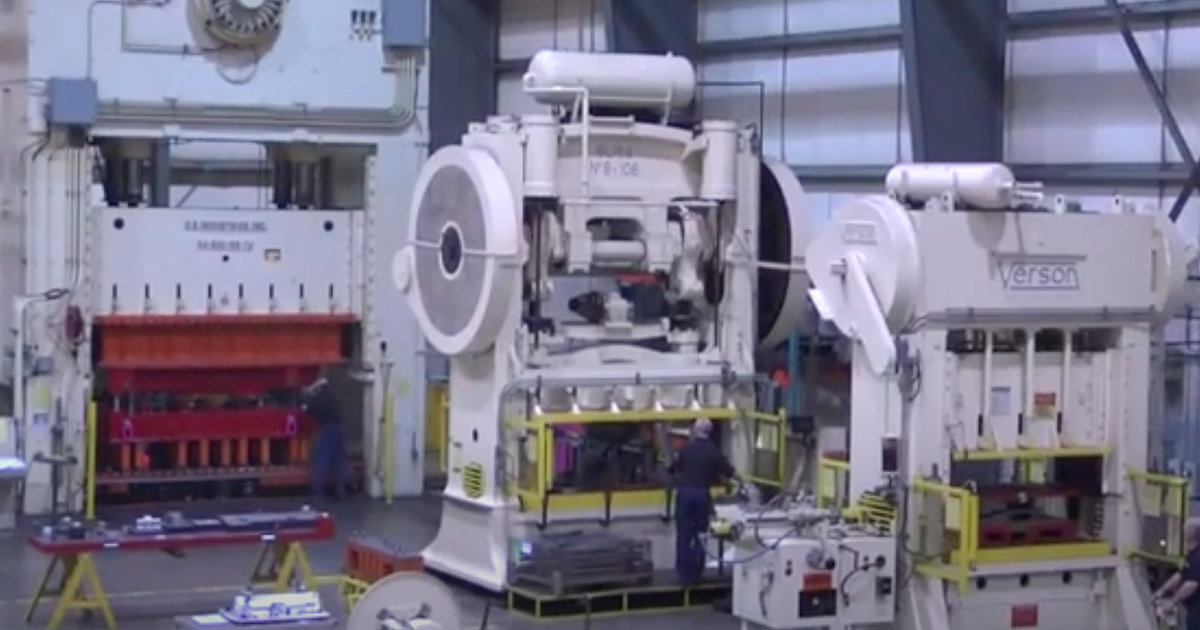

EVs pose challenges for tool-and-die makers. Major systems that are either eliminated or simplified by electrification include transmission, fuel and exhaust, meaning companies that rely on those systems are in danger of losing significant business. EVs also contain fewer parts than a typical internal combustion vehicle.

But there also are opportunities. EVs include components that don’t exist in combustion vehicles, such as battery packs and electric motors, meaning companies can snatch up new business in a quickly growing market.

Bowman Precision Tooling, in Brantford, Ontario, about 70 miles southwest of Toronto, provides automotive metal-stamping dies for advanced, high-strength steel and aluminum parts to the Detroit 3 and European automakers.

About 80 percent of Bowman’s business today is related to BEVs, said Jamie Bowman, the company’s president, and he anticipates that figure will remain high in the years to come as automakers look to used more advanced, lightweight materials in their EVs to increase battery range and efficiency.

“For us, it’s great for business,” he said. “Anytime you have new models, you need new tooling. And typically, that means new tooling for advanced parts, which is less of a commodity. We’re able to offer that.”

Well-run businesses will have an opportunity to get ahead of the pack on the EV transition, Harbour said.

“They’ll capitalize on that and get some new business over the next few years,” she said. “There will be an opportunity. It’s just a function of being able to get financially through now to then.”