The European passenger car market rebounded a little bit in February, exceeding 900,000 new registrations (up 12 percent year-over-year).

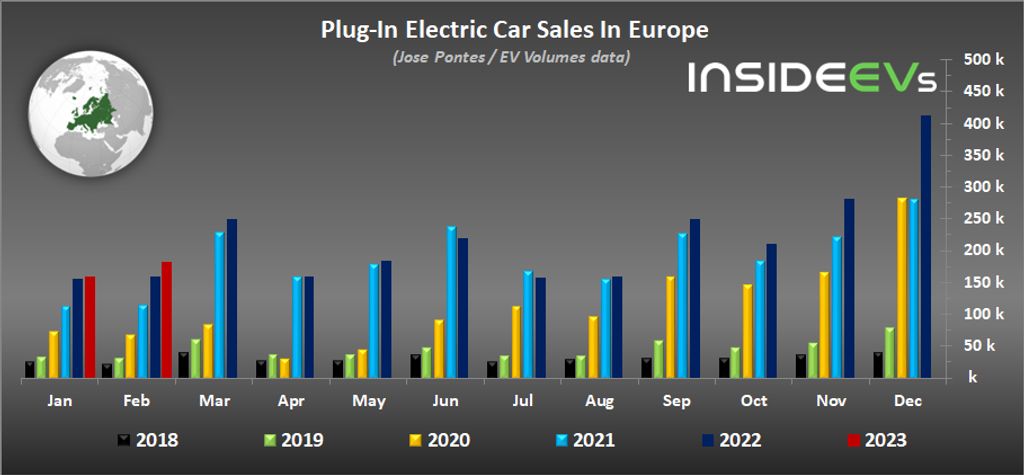

According to EV Volumes data, shared by Jose Pontes, in February some 182,000 new plug-in electric cars were registered in Europe, which is 14 percent more than a year ago. Considering the current situation in Europe, any growth is a positive news, even if it’s just relatively low.

The most important thing is that one if five new cars was rechargeable, while all-electric cars represent 13 percent of the new sales (roughly 118,000). By the way, BEV sales were 31 percent higher than a year ago, which means that the PHEVs are the ones to blame (down 8 percent year-over-year to about 64,000).

New plug-in car registrations:

- BEVs: *118,000 (up 31% year-over-year) and 13% share

- PHEVs: *64,000 (down 8% year-over-year) and 7% share

- Total: 182,333 (up 14% year-over-year) and 20% share

* estimated from the market share

So far this year, more than 340,000 passenger plug-in electric cars were registered in Europe, which is about eight percent more than a year ago.

New plug-in car registrations year-to-date:

- BEVs: about *0.21 million and 12% share

- PHEVs: about *0.13 million and 7% share

- Total: 341,351 (up 8% year-over-year) and 19% share

* estimated from the market share

For reference, in 2022, more than 2.6 million new passenger plug-in electric cars were registered in Europe (about 23 percent of the total volume).

The Tesla Model Y was the best selling plug-in model in February (just like in January), thanks to over 17,000 new registrations. This is far more than any other electric car (even including plug-in hybrids).

The second most popular model was the Volvo XC40 (6,100), but only if we count BEV and PHEV versions together. Third one was the Volkswagen ID.3 (5,382).

Results last month:

- Tesla Model Y – 17,205

- Volvo XC40 (BEV + PHEV) – 6,100

- Volkswagen ID.3 – 5,382

- Volkswagen ID.4 – 5,147

- Fiat 500 electric – 4,844

- Audi Q4 e-tron – 4,713

- Dacia Spring – 4,313

- Peugeot e-208 – 4,052

- Tesla Model 3 – 3,867

- Skoda Enyaq iV – 3,566

The top three for the year is the same as for the month of February. An interesting thing is that the Dacia Spring imported from China is currently above the Volkswagen ID.4, produced at two sites in Germany.

Results year-to-date:

- Tesla Model Y – 24,432

- Volvo XC40 (BEV + PHEV) – 11,978

- Volkswagen ID.3 – 8,752

- Dacia Spring – 8,680

- Volkswagen ID.4 – 8,485

- Audi Q4 e-tron – 8,395

- Fiat 500 electric – 8,103

- Peugeot e-208 – 6,850

- Skoda Enyaq iV – 6,796

- Ford Kuga PHEV – 6,271

In terms of the most popular plug-in brands, Tesla moved from #5 to #1 and has now a slight advantage over Volkswagen, which also improved its position (from #4 to #2).

This year we might see a very interesting race, especially as the Tesla Giga Berlin plant is already producing more than 5,000 cars per week (an equivalent of roughly 250,000 units per year).

Top plug-in brands (share year-to-date):

- Tesla – 9.0%

- Volkswagen – 8.3%

- Mercedes-Benz – 8.1%

- BMW – 7.9%

- Volvo – 7.4%

- Audi – 6.0%

Nonetheless, Tesla is still too small to beat the large automotive groups (when all brands of one group are counted together).

Top plug-in automotive groups (share year-to-date):

- Volkswagen Group – 20.8% share (Volkswagen brand at 8.3%, Audi at 6.0%)

- Stellantis – 14.4% share

- Geely–Volvo – 10.2%

- BMW Group – 9.5% share (BMW brand at 7.9%)

- Tesla – 9.0%