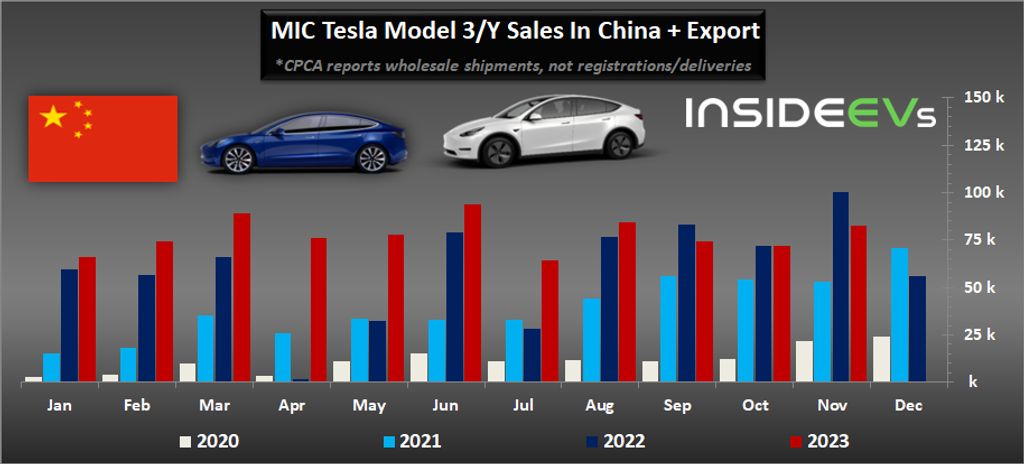

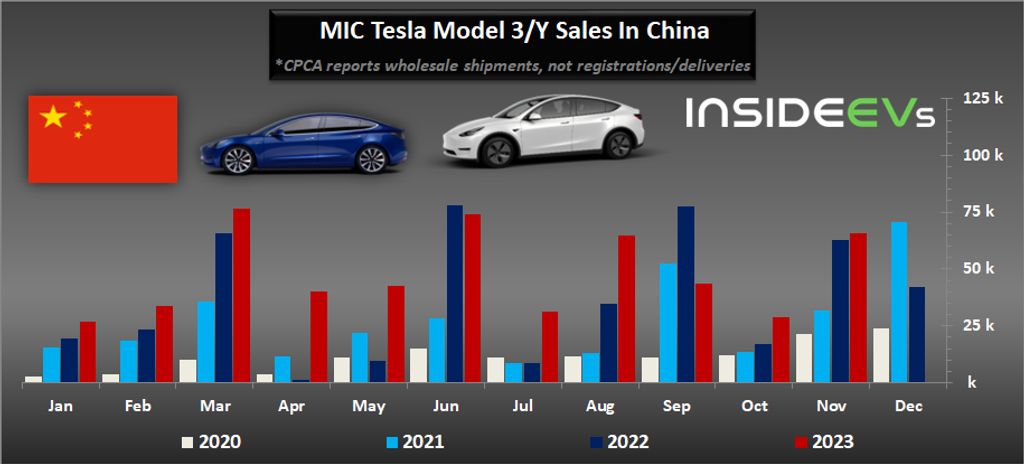

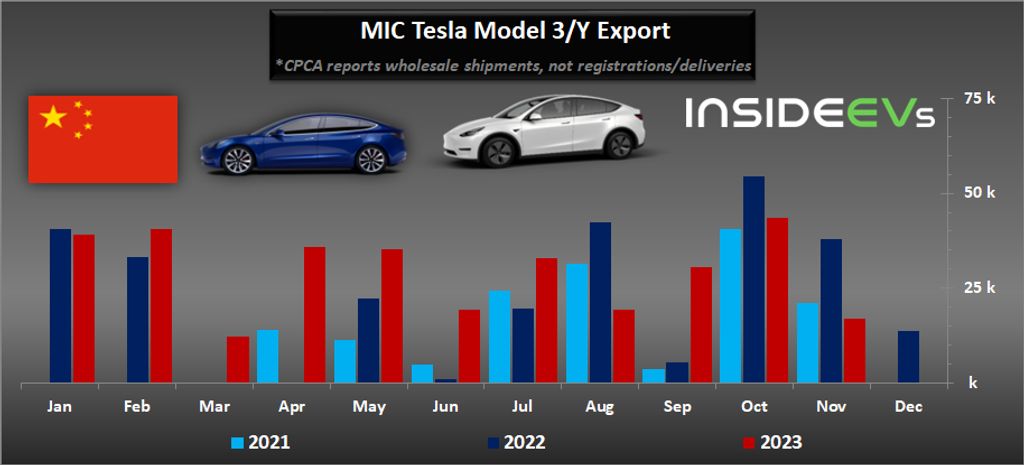

Additional sales data from China reveals an interesting difference between Tesla’s exports and retail sales in the world’s largest electric car market for the month of November.

According to the China Passenger Car Association’s (CPCA) data, out of 82,432 Tesla MIC Model 3/Model Y wholesale vehicle shipments last month, the vast majority falls on local sales—65,504 (up 5% year-over-year), while export represents only a small part of 16,928 units (down 55% year-over-year).

* CPCA reports wholesale shipments, not registrations/customer deliveries.

We are not sure why exports decreased so much, nor why they are down for the second consecutive month (after a 20% drop in October).

Tesla MIC Model 3/Model Y wholesale shipments last month (YOY change):

- Retail sales in China: 65,504 (up 5%)

- Export: 16,928 (down 55%)

- Total wholesale shipments: 82,432 (down 18%)

Nonetheless, the results after 11 months of the year are still positive. Retail sales in China and exports are up year-over-year by about a third.

The main issue is that the year-over-year growth rate significantly decreased despite the fact that the company reduced prices (affecting its margins).

Tesla MIC Model 3/Model Y wholesale shipments year-to-date (YOY change):

- Retail sales in China: 527,859 (up 33%)

- Export: 325,744 (up 27%)

- Total wholesale shipments: 853,603 (up 30%)

Model Sales

In terms of models, in November, the total wholesale shipments decreased compared to November 2022:

- MIC Model 3: 23,999 (down 23%)

- MIC Model Y: 58,433 (down 15%)

That’s an interesting outcome, considering that both models were refreshed—the Model 3 (code name Highland) has been significantly upgraded while the Model Y has been slightly updated.

Even more interesting is that the Model 3 wholesale shipments in November were lower than in October (24,951) and not much higher than in July-September (over 20,000).

One of the explanations is that the Tesla Giga Shanghai factory might not be able to produce a higher number of the new Model 3 cars yet.