In December, new passenger car registrations in Germany amounted to 241,883, which is a significant 23% drop compared to a year ago. In 2023, 2,844,609 new cars were registered (up 7.3%).

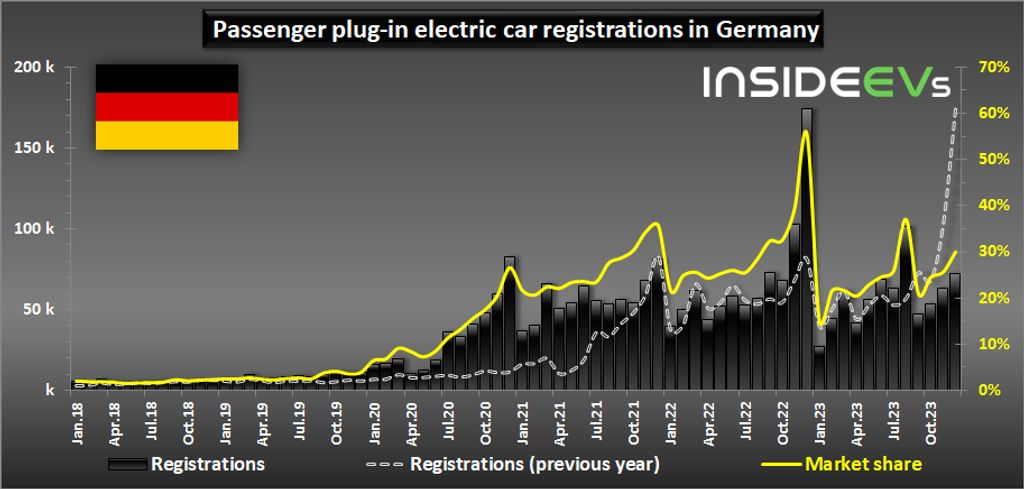

However, after a surprising elimination of generous incentives for all-electric cars ($4,930 / 4,500 euro), which was applied on December 17, the EV segment shrunk.

Get Fully Charged

German EV market

Germany is Europe’s largest car market and plug-in electric cars are no exception. Any significant movement in Germany also translates into Europe’s results.

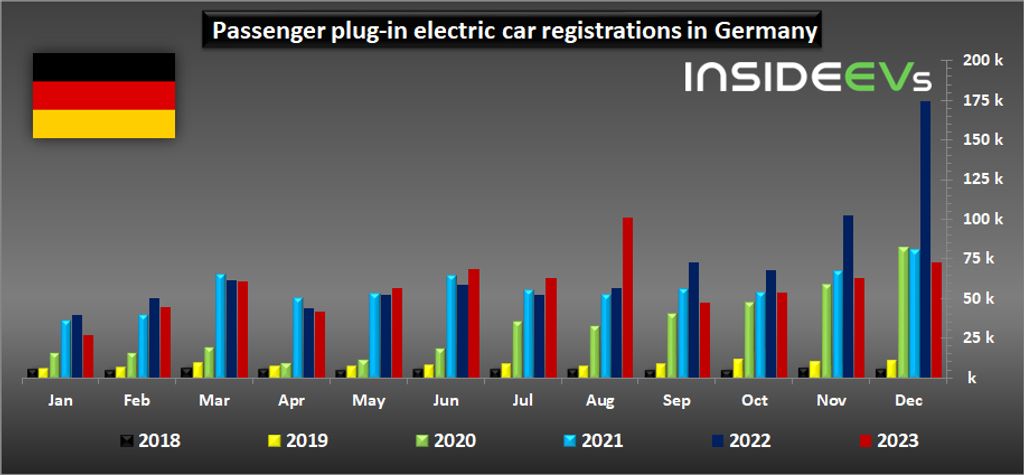

In December, the total new plug-in electric car registrations amounted to 72,548, which is 58% less than a year ago, although we must remember that December 2022 was a record month (an artificial one) with over 174,000 plug-in registrations and 55% share. At the time, the government applied the first reduction of the EV incentives (reduction for BEVs, elimination of PHEVs). The recent result is more reasonable and closer to the real position of the EV segment.

Nonetheless, the situation is not as bad as one might think, because some 30% of all new cars in December were rechargeable.

Battery electric car (BEV) registrations decreased by 48% year-over-year in December to 54,654, although their market share of 22.6% remains relatively high (almost three times higher than in the U.S., estimated at 8%).

Plug-in hybrid car (PHEV) registrations decreased (twelve times in a row) by 74% year-over-year to 17,894. It was a weak year for PHEVs, without the support of incentives since January 2023. We will see how BEVs will be able to cope with the new reality in 2024.

Plug-in car registrations last month (YOY change):

- BEVs: 54,654 (down 48%) and 22.6% market share

- PHEVs: 17,894 (down 74%) and 7.4% market share

- Total: 72,548 (down 58%) and 30% market share

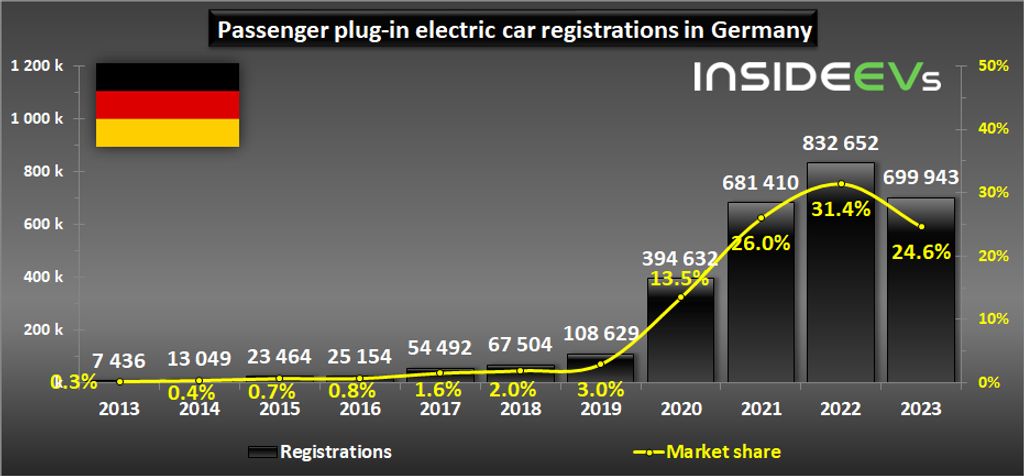

In 2023, 699,943 new passenger plug-in electric cars have been registered in Germany, which is close to 25% of the total volume.

Despite the recent weaker months, all-electric cars noted an increase in 2023 by 11% year-over-year to 524,219 and 18.4% share (compared to 17.7% a year ago).

Plug-in car registrations in 2023 (YOY change):

- BEVs: 524,219 (up 11%) and 18.4% market share

- PHEVs: 175,724 (down 51%) and 6.2% market share

- Total: 699,943 (down 16%) and 24.6% market share

For reference, in 2022, more than 832,000 new passenger plug-in cars were registered in Germany (31.4% of the total volume), compared to over 681,000 (26% share) in 2021.

The graph below shows us how the incentives boosted the 2022 sales results.

The biggest question is what will happen in 2024—a weakening is clearly on the table (if the incentives do not return) and new troubles have emerged too (supply chain issues related to the conflict in the Red Sea).

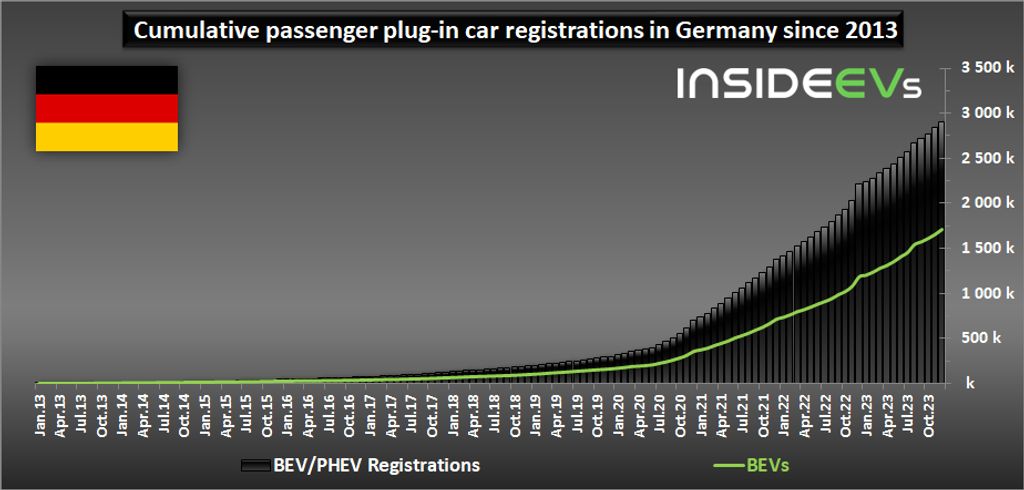

Cumulatively, there are already some 3 million plug-in cars sold in Germany (including over 1.7 million all-electric).

In December, BMW surprised us with an outstanding sales record. The company noted 10,342 new plug-in car registrations (0.8% more than a year ago), including 8,257 all-electric cars (up 83% year-over-year).

Next were Volkswagen (7,147) and Mercedes-Benz (6,631), while Tesla noted just over 4,000 units (down 77% year-over-year). We guess that Tesla was affected by the cut of incentives in the middle of the month, as it usually delivers a large number of cars at the end of a month.

Plug-in car registrations by brands (at least 3,000) last month:

- BMW: 10,342 – 8,257 BEVs and 2,085 PHEVs

- Volkswagen: 7,147 – 6,183 BEVs and 964 PHEVs

- Mercedes-Benz: 6,631 – 2,688 BEVs and 3,943 PHEVs

- Seat: 5,601 – 2,525 BEVs and 3,076 PHEVs

- Opel: 4,463 – 4,014 BEVs and 449 PHEVs

- Audi: 4,428 – 2,922 BEVs and 1,506 PHEVs

- Tesla: 4,001 BEVs

- Skoda: 3,626 – 3,185 BEVs and 441 PHEVs

- Fiat: 3,177 BEVs

After 12 months of the year, Volkswagen managed to return to first place, ahead of Mercedes-Benz, but it was a close race as both brands noted over 78,000 plug-in car registrations.

Volkswagen sold the highest number of all-electric cars in Germany, while Mercedes-Benz is the king of plug-in hybrids. Tesla was the second best in terms of BEV sales with 63,685 registrations, but its result was 9% lower than a year ago. That’s a surprise—or maybe not if we take into account 17,501 registrations in December 2022 (incentives).

Plug-in car registrations by brands (at least 15,000) in 2023:

- Volkswagen: 78,427 – 70,628 BEVs and 7,799 PHEVs

- Mercedes-Benz: 78,138 – 36,703 BEVs and 41,435 PHEVs

- Tesla: 63,685 BEVs

- BMW: 62,261 – 40,420 BEVs and 21,841 PHEVs

- Audi: 47,131 – 30,596 BEVs and 16,535 PHEVs

- Opel: 34,341 – 27,765 BEVs and 6,576 PHEVs

- Hyundai: 34,068 – 28,845 BEVs and 5,223 PHEVs

- Seat: 32,306 – 17,504 BEVs and 14,802 PHEVs

- Skoda: 29,959 – 23,499 BEVs and 6,460 PHEVs

- Fiat: 23,180 BEVs

- Kia: 21,186 – 15,099 BEVs and 6,087 PHEVs

- MG Roewe: 18,550 – 18,526 BEVs and 24 PHEVs

- Volvo: 17,485 – 8,502 BEVs and 8,983 PHEVs

- smart: 17,416 BEVs

- Renault: 16,206 – 15,505 BEVs and 701 PHEVs

- Ford: 15,242 – 3,852 BEVs and 11,390 PHEVs

The Tesla Model Y was the best-selling all-electric car model in Germany in 2023 with more than 45,800 new registrations.

The second best was the Volkswagen ID.4/ID.5 duo with over 36,300 units, followed by the Skoda Enyaq iV (23,498 units) and Fiat 500 electric (22,608), which both outpaced the Volkswagen ID.3 with 22,270 units in the very last month.

Top all-electric models in 2023 (YOY change):

- Tesla Model Y – 45,818 (up 29%)

- Volkswagen ID.4/ID.5 – 36,353 (up 46%)

- Skoda Enyaq iV – 23,498

- Fiat 500 electric – 22,608

- Volkswagen ID.3 – 22,270 (down 4%)

- Audi Q4 e-tron – 18,061

- Cupra Born – 17,464

- Tesla Model 3 – 15,865