NEW YORK — Lincoln’s new president is working to galvanize the luxury brand’s stalled revival by shrinking its dealer network, refocusing its electrification strategy and updating its products to spark interest from new and returning customers.

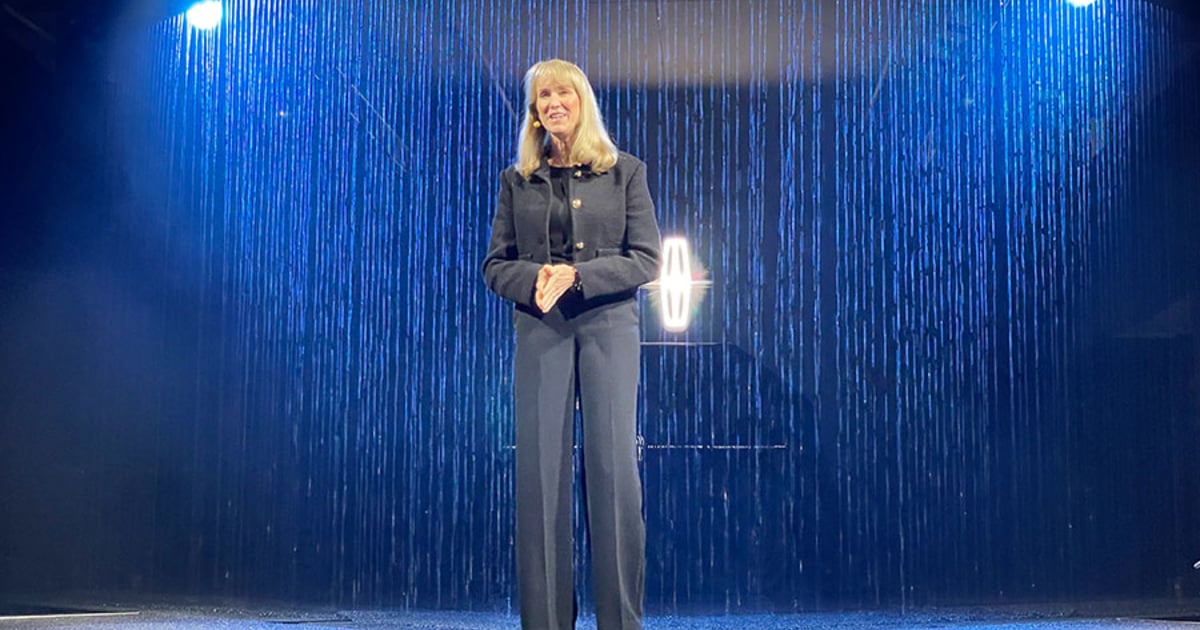

“We have to get our mojo back,” Dianne Craig told Automotive News this week in New York as Lincoln introduced the redesigned Nautilus, a product she hopes will be key to that plan.

Lincoln executives spent much of the past decade working to make the brand relevant again in an increasingly crowded luxury market. Their efforts succeeded to an extent — U.S. sales topped 112,000 vehicles in 2019, a 12-year high — then flatlined when the pandemic hit.

Craig, who succeeded Joy Falotico in December, now vows that Lincoln will grow again.

“It’s really very straightforward — great products, great service,” she said. “That will define the future of the brand.”

Many of Lincoln’s retailers, however, may not be part of that future.

Although Craig called the brand’s dealer network a “strategic advantage,” she said it must get smaller. Lincoln had 637 dealers at the start of 2023, according to Automotive News’ annual dealer census.

“We have too many dealers,” Craig said. “If we’re going to be a successful luxury brand, we need brand-exclusive facilities. Most of the dealers we have are still dualed. We love them as our Ford partner, but we need to focus on having that brand-exclusive experience.”

As of late last year, Lincoln had about 145 standalone stores. It has been asking dealers in the top 120 markets to invest in new single-brand showrooms.

Craig declined to say how many stores the brand should have but suggested it could be around 356, the number of dealers who have signed up for Lincoln’s electric vehicle certification program.

“At the end of the day, all I know is we have too many,” she said. “As we evolve to EVs with the dealers that signed up with our EV tenets, it’s probably in the right snap bracket to where we ultimately need to go, and we’ll work really closely with the dealers to get there.”

A Lincoln spokesperson said the company will work with dealers individually to address their differing needs “as this is not a one-size-fits-all approach.” Craig said company officials were having discussions with “all of our dealers” about remaining with the brand.

“I’ve had many conversations with dealers over the last four months, many that are my personal friends, that don’t want to give up the brand because they love the brand,” she said. “But … if there’s not an industry there to serve, does it really make sense for them to go on this next evolution with the investments they’ll have to make for EV? Or just focus on Ford? We want to do the right thing for them as business partners.”

Lincoln has lagged much of the industry in rolling out EVs, which is particularly problematic in a luxury market that’s now dominated by Tesla and with major competitors offering multiple EVs.

Craig has indicated she may be taking a different approach than the brand’s predecessors, saying she will not specify how many EVs or what year they might arrive.

“When I’m ready to make a declaration about when we’re ready to come to market with our first EV or second EV, it will be when we’re really ready to talk about it,” she said. “The most important thing I’m focused on is to make sure we have EVs that we bring to market that are irresistible.”

Lincoln has said that it plans to launch three EVs globally by 2025 with a fourth coming in 2026, and that 90 percent of its U.S. volume will be from electrified products by 2030.

Craig did not reaffirm that plan, which was established by past leaders.

“No declarations on how many or confirming what was stated in the past,” she said. “It’s not my focus. My focus isn’t on the timing or how many; it’s making sure we get the EVs right.”

As part of that new focus, Lincoln tweaked the company’s EV certification program for dealers by deferring the timetable for adding EV chargers.

“As the market and EV adoption continues to evolve, we have modified the program to allow for a slightly longer grow-in period for Lincoln retailers to account for future energy demands, product and infrastructure investment,” the company said in a recent memo to dealers obtained by Automotive News.

Among the changes: Dealers are no longer required to install a Level 2 charger in the new-vehicle delivery area, while the first deadline to install chargers has been deferred from November 2024 to March 2025. In addition, a second deadline to add a Level 3 public-facing charger has been deferred to July 2026, and the program now covers three years, from 2025 to 2027, instead of the original two.

“Our dealers, who are working with their local providers, are saying there’s a lot of confusion out there amongst them as well,” Michael Sprague, Lincoln’s North America director, told Automotive News. “Let’s take a little step back and give everybody a little breathing room.”

He said Lincoln will reopen the certification program for those dealers who did not originally sign up but now want to. The estimated price remains unchanged; the brand is asking dealers to spend up to $900,000 on the program.

Despite the industry’s pivot to EVs, Craig said gasoline-powered and hybrid models will continue to play an important role for the brand.

“As much as we’re finally seeing EVs take off, we’ve been talking about it for 20 years,” she said. “And for as many entries that came in, it was never more than 1 or 2 percent of the industry. But 75 percent of customers are still choosing gas or hybrids. Take the next few years, it only goes from 75 down to 65. For the foreseeable future, we’re going to see the majority of folks still going for gas and hybrids.”

The 2024 Lincoln Nautilus crossover is an example of the type of product that Craig and other executives hope lead the brand to a sales rebound.

Lincoln’s U.S. volume has declined in each of the past three years amid the pandemic and inventory shortages. Its portfolio has shriveled to just four nameplates after dropping sedans from this market.

COVID-19 made the brand’s once unique services, such as pickup and delivery, ubiquitous even among mainstream makes. And even its “quiet flight” mantra that inspired Lincoln’s award-winning interiors has lost some meaning in a luxury market increasingly filled with silent all-electric powertrains.

The Nautilus cabin is what Craig and other executives call the “evolution” of that quiet flight theme. It includes a new 48-inch display screen and comes with an optional Lincoln Rejuvenate mode featuring lights, sounds and smells designed to create a peaceful environment.

“We’re taking these interiors to a whole new level,” Craig said.

She said Lincoln must also work to differentiate itself from competitors with new services.

“Customers want convenience on their terms,” she said. “We have to be uberconvenient to do business with.”

Ultimately, Craig expects Lincoln sales in the U.S. to turn around, especially as inventory levels return to normal, although she declined to offer a sales target.

“We’re going to grow,” she said. “That’s our plan.”