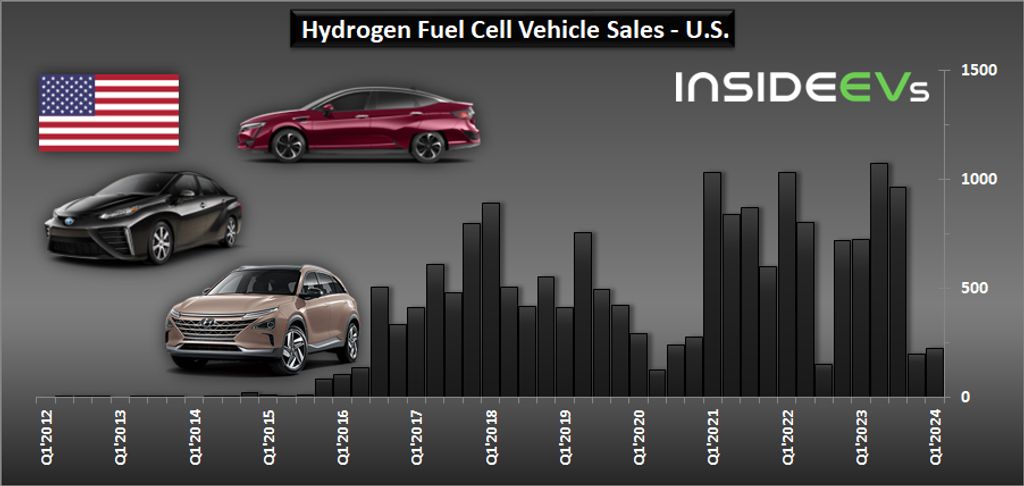

Hydrogen fuel cell car sales in the United States—and by that, we mean in California, where the series-produced models are available—continued to decrease at a significant rate in recent months.

According to the Hydrogen Fuel Cell Partnership’s data, 223 new hydrogen fuel cell cars (aka FCV or FCEV) were sold in the U.S. in Q1. It’s 70% less than a year ago, the slowest first quarter since 2016 and the second such slow quarter in a row.

Hydrogen Fuel Cell cars are zero-emission

The cars powered by hydrogen fuel cells are kind of like series-hybrids, where hydrogen is used to generate electricity for the electric motor. It’s a different approach to achieving zero-emission driving, compared to battery electric vehicles, which are powered solely by batteries.

The Hydrogen Fuel Cell Partnership’s FCVs sales data comes from Baum and Associates and is based on sales to retail and fleet customers.

When it comes to FCV models, there are only two. The Toyota Mirai is the primary one with 172 sales in Q1 (down 74% year-over-year). The Hyundai Nexo sells at a noticeably lower volume—51 units in Q1 (down 22% year-over-year).

Honda no longer offers the Honda Clarity Fuel Cell, but the Japanese company is introducing a hydrogen plug-in model the 2025 Honda CR-V e:FCEV, which InsideEVs checked out in March. This model will not boost the struggling FCV segment, because it will be in limited supply.

On top of the limited car availability, the issues for the segment are high prices of hydrogen and weak refueling infrastructure. Shell announced in February that it would close all seven sites in California immediately.

Hydrogen car sales in Q1’2024 (YOY change):

- Total: 223 (down 70%)

Hydrogen sales reported by the manufacturers in Q1’2024 (YOY change):

- Toyota Mirai: 172 (down 74%)

- Hyundai Nexo: 51 (down 22%)

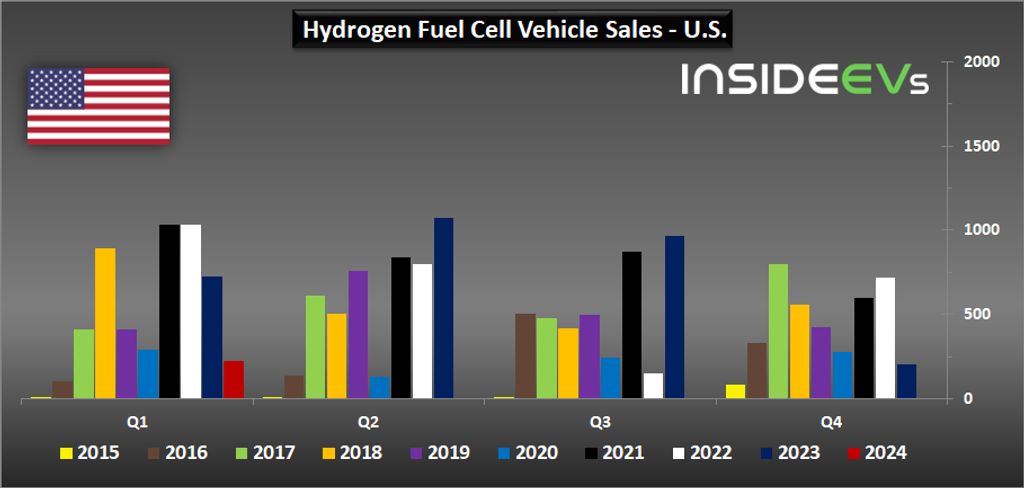

For reference, in 2023, 2,978 new hydrogen cars were sold (the numbers were updated compared to the previous report), some 10% more than in 2022.

Hydrogen car sales in Q1-Q4’2023 (YOY change):

- Total: 2,978 (up 10%)

Hydrogen sales reported by the manufacturers in Q1-Q4’2023 (YOY change):

- Toyota Mirai: 2,737 (up 31%)

- Hyundai Nexo: 241 (down 41%)

There is a chance that with another shipment of FCVs from Japan or South Korea, sales will increase in the following quarters. However, overall the zero-emission competition with all-electric cars appears to be over. Maybe it never really started.

The window of opportunity for FCVs closed when EVs were strengthened by long-range versions and promising fast charging solutions (up to 80% state-of-charge in less than 20 minutes). At the same time, none of the FCV issues were solved—overall efficiency compared to EVs, high cost of vehicles and refueling, as well as lack of refueling infrastructure.

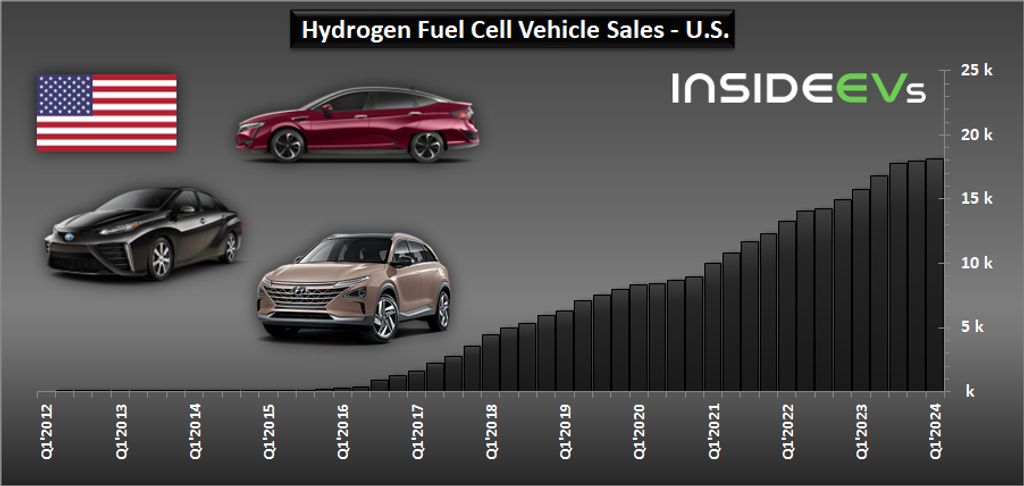

The overall cumulative sales of FCVs in the U.S. exceeded 18,000 as of the end of the quarter (not counting vehicles removed from use), which is 16% more than a year ago. This number includes over 14,000 Toyota Mirai (almost 79% of all FCVs).

We guess that at this rate, the 25,000th hydrogen fuel cell car will be sold no earlier than late 2025.

As of January 10, 2024, the number of open retail hydrogen stations in California stood at 55 (the same number as in January):

- Open – Retail: 55 (stable)

- Open – Legacy Retail: 0

- Currently Unavailable: 6

- In Construction: 2

- In Permitting: 18

- Proposed: 4

- On hold: 5

- Total (Light Duty): 90 (down from 97)

The number of sites under construction, in permitting or proposed status, decreased compared to the previous reports. See the full list of hydrogen infrastructure here.

A quick calculation reveals that there are 331 cars per single station (cumulative sales divided by the number of open retail stations). Although, it’s less due to the early cars that have been removed from service.