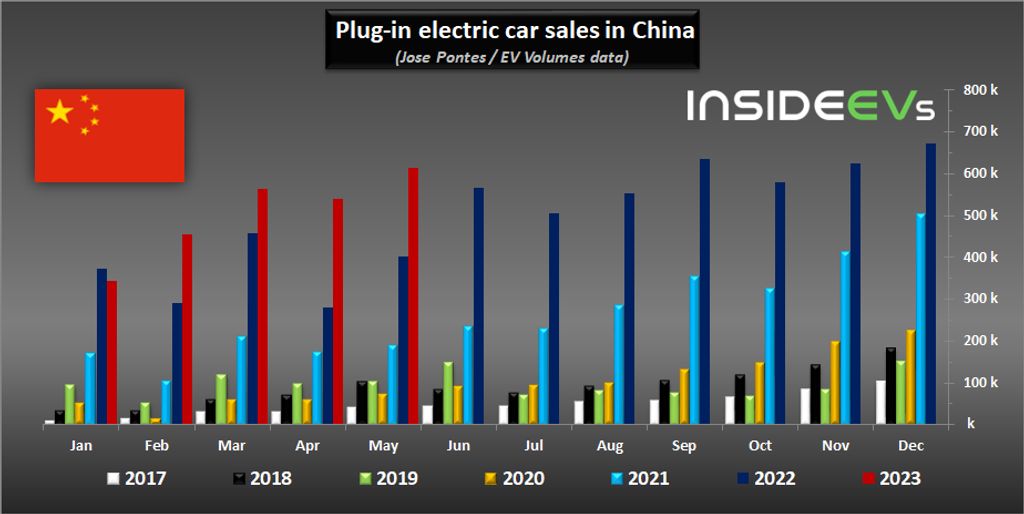

Plug-in electric car sales in China continued to grow in May, taking more than a third of the entire car market.

According to EV Volumes’ data, shared by Jose Pontes, some 614,361 new passenger plug-in electric cars were registered in China in May, which is 54 percent more than a year ago.

Rechargeable cars represent some 35 percent of the total new passenger car sales, which is far more than in Europe or in the United States.

An even more spectacular thing is that China represented around 60 percent of the total global plug-in car registrations for the month of May.

According to the data, BEVs outsell PHEVs more than 2:1 in China. BEV sales noticeably exceeded 400,000 in May, which was 24 percent of the total market.

Results for the month:

- BEVs: *421,000 and 24% share

- PHEVs: *193,000 and 11% share

- Total: 614,361 (up 54% year-over-year) and 35% share

* estimated from the market share

So far this year, more than 2.5 million new plug-in electric cars were registered in China (up roughly 41 percent year-over-year), which is about 35 percent of the total volume.

Results year-to-date:

- BEVs: about *1.75 million and 24% share

- PHEVs: about *0.80 million and 11% share

- Total: 2,548,127 (up 41% year-over-year) and 35% share

* estimated from the market share

For reference, in 2022, over 5.92 million new passenger plug-in electric cars were registered in China (30 percent of the total volume).

In May, the BYD Qin Plus family of BEV and PHEV versions was the most popular one (42,887, including 10,816 BEVs), noticeably ahead of the BYD Song Plug plug-in family (37,610).

However, when it comes to all-electric cars, the Tesla Model Y (31,054) was number one, slightly ahead of the all-electric BYD Dolphin (30,441). Overall, we can see four BEV models in the top five and six in the top ten.

Top 10 plug-ins for the month:

- BYD Qin Plus (BEV + PHEV): 42,887

- BYD Song Plus (BEVs + PHEVs): 37,610

- Tesla Model Y: 31,054

- BYD Dolphin: 30,441

- BYD Yuan Plus (aka Atto 3) BEV: 26,072

- GAC Aion S: 25,233

- Wuling Hong Guang MINI EV: 20,346

- BYD Han (BEV + PHEV): 20,158

- GAC Aion Y: 19,306

- BYD Seagull: 14,300

After the first five months of the year, the BYD Song Plus remains at the top with a huge advantage over other models, but the BYD Qin Plus is consistently decreasing the distance.

As far as all-electric cars are considered, the Tesla Model Y is the most popular model.

Top 10 plug-ins year-to-date:

- BYD Song Plus (BEVs + PHEVs): 215,825

- BYD Qin Plus (BEV + PHEV): 162,129

- Tesla Model Y: 152,461

- BYD Yuan Plus (aka Atto 3) BEV: 135,576

- BYD Dolphin: 130,951

- Wuling Hong Guang MINI EV: 108,271

- GAC Aion S: 93,112

- BYD Han (BEV + PHEV): 72,561

- GAC Aion Y: 71,426

- Tesla Model 3: 67,432

* BEV and PHEV versions of the same models were counted together in the source.

BYD is the most popular brand and automotive group in China, and this is not expected to change anytime soon.

Top brands by share in the plug-in segment year-to-date:

- BYD: 36.0%

- Tesla: 8.7%

- GAC Aion: 6.6%

- SAIC-GM-Wuling: 6.0%

- Li Auto: 4.2%

Top automotive groups by share in the plug-in segment year-to-date:

- BYD: 37.8%

including Denza brand - Tesla: 8.7%

- SAIC: 7.6%

including SAIC-GM-Wuling joint venture (between SAIC, GM and Liuzhou Wuling Motors) - GAC: 6.9%

- Geely-Volvo: 5.3%

- Changan: 4.5%