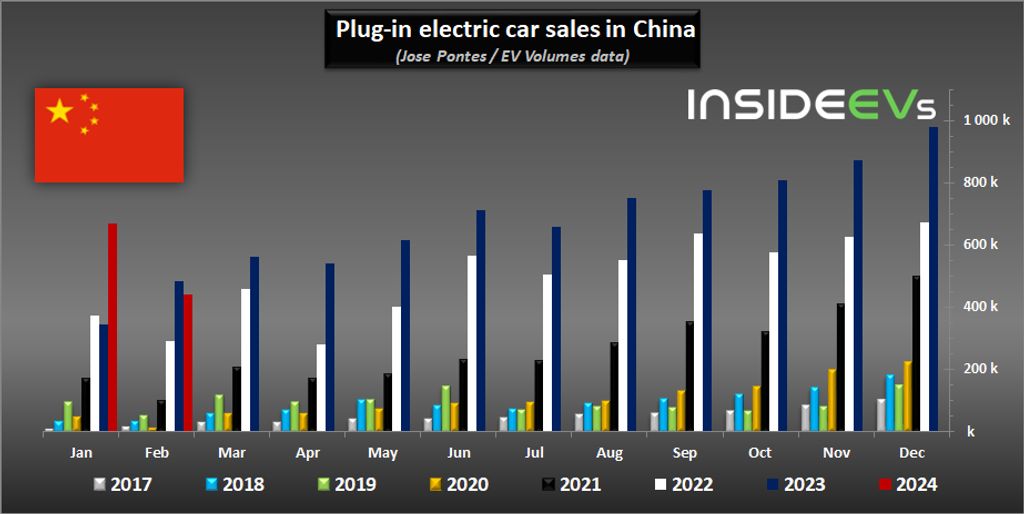

February brought an expected weakening of plug-in electric car sales in China. The main reason behind that is the 2024 Chinese New Year holiday (between February 10th and 17th ) and that a year ago the holidays were in January.

According to EV Volumes‘ data, shared by researcher Jose Pontes, roughly 440,000 new passenger plug-in electric cars were registered in China in February, 9% less than a year ago. Nonetheless, the market remains EV-hungry, as the rechargeable car’s share amounted to 33%.

Get Fully Charged

Plug-in car sales surges in China

The Chinese plug-in electric car market is not only the largest one in the world but it also represents the majority of global plug-in car sales. The share of rechargeable cars in China in 2023 amounted to 37% (compared to 30% in 2022).

All-electric car registrations decreased 20% year-over-year in February, representing about 22% of the country’s total volume.

At the same time, plug-in hybrid car registrations increased by 22% year-over-year. It means that there is some serious demand for PHEVs (including EREV series hybrids with plug-in capability) in China right now.

Plug-in car registrations for the month (YOY change):

- BEVs: about *293,000 (down 20%) and 22% market share

- PHEVs: about *147,000 (up 22%) and 11% market share

- Total: 440,000 (down 9%) and 33% market share

* estimated from the market share

During the first two months of the year, more than 1.1 million new plug-in electric cars were registered in China (up roughly 41% year-over-year). It’s about a third of the market.

Plug-in car registrations in January-February (YOY change):

- BEVs: about *0.67 million and 20% market share

- PHEVs: about *0.44 million and 13% market share

- Total: 1,125,163 (up 41%) and 33% market share

* estimated from the market share

For reference, in 2023, more than 8 million new plug-in electric cars were registered in China (up roughly 46% year-over-year). It was about 37% of the total volume (compared to 30% in 2022, 15% in 2021 and 6.3% in 2020).

Considering the strong start of the year, 2024 should be even better, most likely above 10 million units.

In February, the top three plug-in car nameplates in China were: the BYD Qin family with 27,851 units (mostly PHEVs), the Tesla Model Y with 22,537 units, and the BYD Song family with 22,079 units (mostly PHEVs).

Just off the podium was the Aito M7 (from the Huawei and Seres’ joint venture), an EREV SUV, with over 21,000 units sold.

Top 10 plug-ins in February:

- BYD Qin Plus: 27,851 (3,610 BEVs + 24,241 PHEVs)

- Tesla Model Y: 22,537

- BYD Song Plus: 22,079 (2,597 BEVs + 19,482 PHEVs)

- Aito M7 (EREV): 21,083

- BYD Seagull: 14,403

- Wuling Hong Guang MINI EV: 12,649

- BYD Dolphin: 9,213

- Li Xiang L7: 8,459

- BYD Yuan Plus (aka Atto 3): 8,210

- Wuling Bingo: 8,087

After the first two months, the podium is slightly different, as the BYD Song family is ahead of the BYD Qin family and the Tesla Model Y. The Tesla Model Y remains the best-selling all-electric car.

Top 10 plug-ins in January-February:

- BYD Song Plus: 74,298 (9,159 BEVs + 65,139 PHEVs)

- BYD Qin Plus: 57,095 (8,223 BEVs + 48,872 PHEVs)

- Tesla Model Y: 52,449

- Aito M7 (EREV): 51,080

- BYD Seagull: 42,453

- Wuling Hong Guang MINI EV: 28,169

- BYD Dolphin: 25,599

- BYD Yuan Plus (aka Atto 3): 25,041

- Li Xiang L7: 21,802

- Changan Lumin: 19,886

* BEV and PHEV versions of the same models were counted together in the source.

BYD continues its domination in the Chinese plug-in market with a huge 28.3% share in the plug-in car segment (29.2% when including its satellite brands), and this is not expected to change in the near term.

Top brands by share in the plug-in segment in January-February:

- BYD: 28.3%

- Tesla: 6.2%

- SAIC-GM-Wuling: 6.2%

- Aito: 5.3%

- Geely: 5.2%

Top automotive groups by share in the plug-in segment in January-February:

- BYD: 29.2%

including Denza, Fang Cheng Bao and Yangwang brands - Geely-Volvo: 9.3%

- SAIC: 8.9%

including the SAIC-GM-Wuling joint venture (between SAIC, GM, and Liuzhou Wuling Motors) - Changan: 6.6%

- Tesla: 6.2%