Hyundai Motor Company’s (Hyundai and Genesis brands) global vehicle sales in December amounted to 342,919, down 0.8% year-over-year. In 2023, the company sold 4,216,680 vehicles (up 6.9% year-over-year).

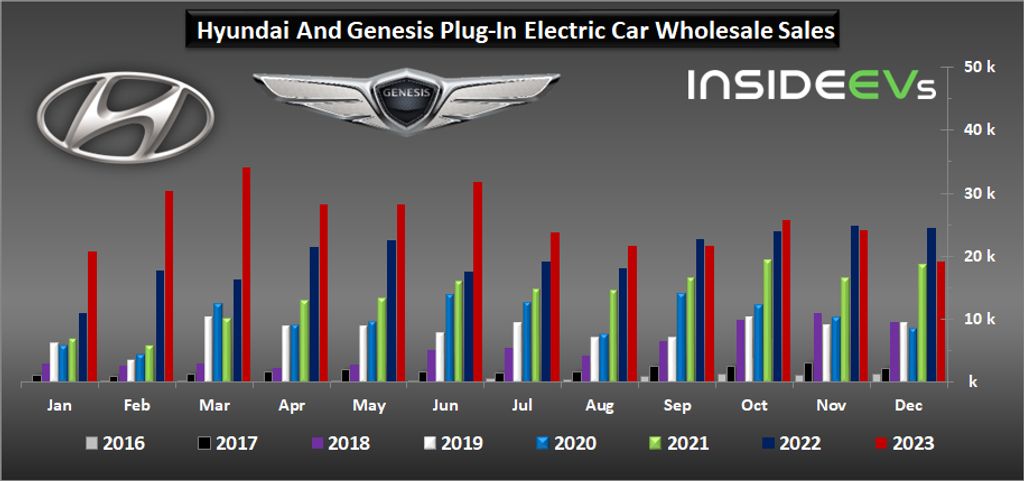

Unfortunately, December brought relatively weak sales of plug-in electric cars (a fifth lower than a year ago), despite that, the year as a whole was still a record result.

Get Fully Charged

Hyundai EV sales hit new record in 2023

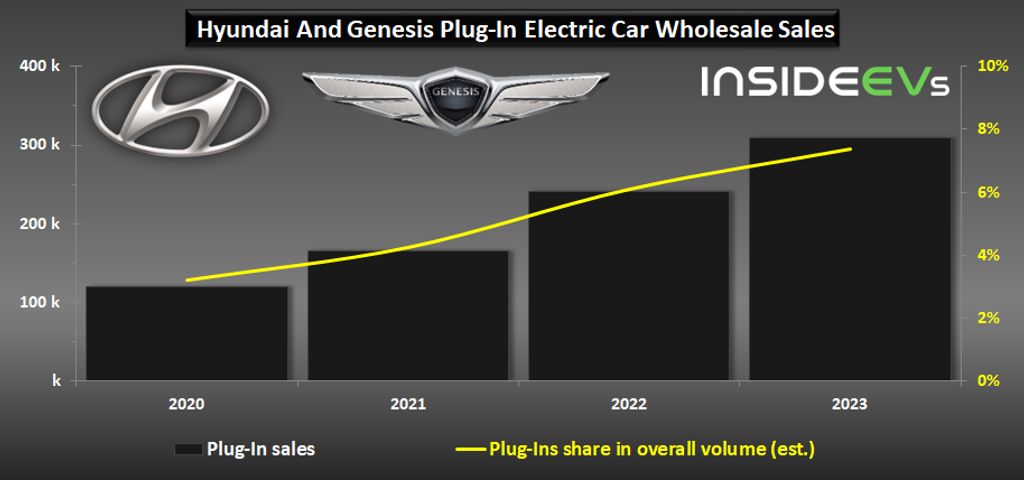

In 2023, Hyundai Motor’s global plug-in car sales exceeded 300,000, which is almost a third more than in 2022. This includes over 260,000 all-electric Hyundai and Genesis cars.

Last month, the combined wholesale shipments (which are closely related to production) of Hyundai and Genesis plug-in cars amounted to *19,097 (down 22% year-over-year). We estimate it is around 5.6% of the automaker’s total sales volume (compared to 7.1% a year ago).

*Retail sales in South Korea plus overseas sales (based on wholesales; at the manufacturer level), unaudited and on a preliminary basis.

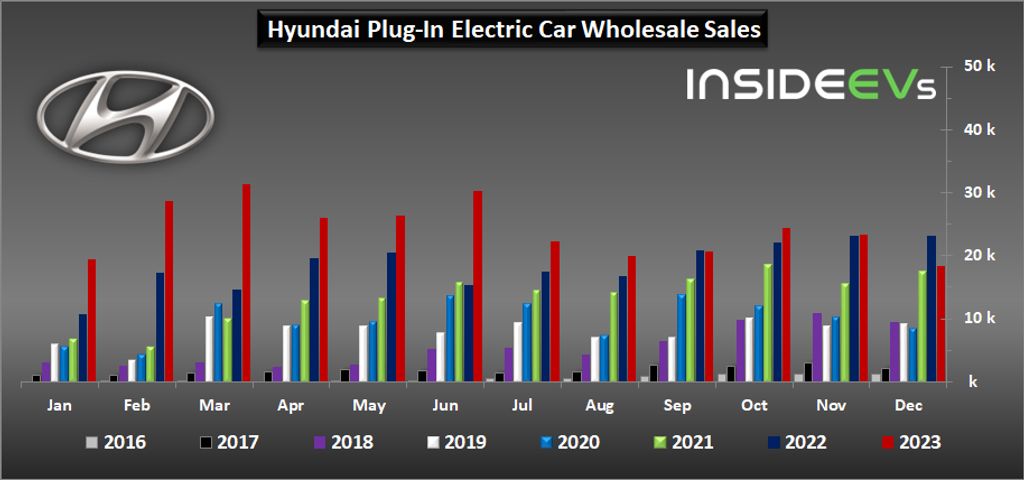

All-electric car volume decreased by 24% year-over-year to 16,601, including 15,857 Hyundai BEVs (down 23% year-over-year) and 744 Genesis (down 41% year-over-year). Plug-in hybrid car volume amounted to 2,496 (down 7% year-over-year).

Such a noticeable drop, combined with a few previous months without much growth (or a decline), potentially indicates challenges on the horizon.

Wholesale plug-in car sales last month (YOY change):

- BEVs: 16,601 (down 24%) and 4.8% share

Hyundai BEVs: 15,857 (down 23%)

Genesis BEVs: 744 (down 41%) - PHEVs (Hyundai): 2,496 (down 7%) and 0.7% share

- Total plug-ins: 19,097 (down 22%) and 5.6% share

- FCVs (Hyundai): 80 (down 82%) and 0% share

In 2023, plug-in electric car wholesale shipments exceeded 309,000 (up 29% year-over-year), which is about 7.4% of the total volume. All-electric car sales almost reached 260,000 (up 33% year-over-year), accounting for 6.2% of the total volume.

Wholesale plug-in car sales year-to-date (YOY change):

- BEVs: 259,442 (up 33%) and 6.2% share

Hyundai BEVs: 240,683 (up 37%)

Genesis BEVs: 18,759 (down 0.5%) - PHEVs (Hyundai): 50,393 (up 11%) and 1.2% share

- Total plug-ins: 309,835 (up 29%) and 7.4% share

- FCVs (Hyundai): 4,552 (down 57%) and 0.1% share

For reference, in 2022, Hyundai Motor Company sold more than 240,000 plug-in electric cars (up 45% year-over-year), including nearly 195,000 all-electric (up 56%).

Retail sales of all-electric cars (including commercial vehicles), according to a separate report, amounted to 268,785. That’s 9,343 higher than the wholesale shipments.

The year 2023 wass the best ever in terms of Hyundai (and Genesis) electrification, but not without challenges.

Hyundai brand

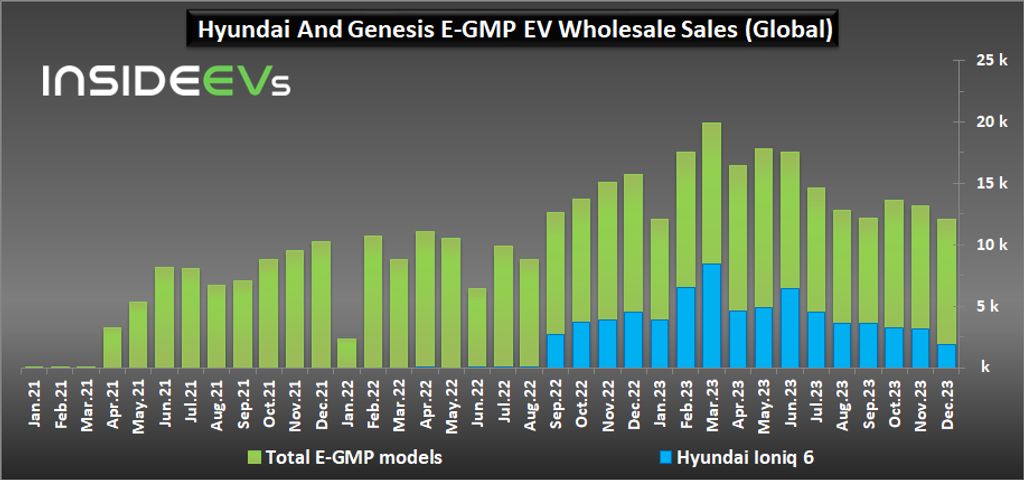

In December, wholesale shipments of the E-GMP-based models (Hyundai Ioniq 5, Hyundai Ioniq 5 N, Hyundai Ioniq 6, and Genesis GV60) decreased by 23% year-over-year to 12,088. Surprisingly, it’s the lowest level this year and since August 2022.

It’s a very interesting outcome, especially since Kia more than doubled E-GMP car sales.

The top three all-electric models in the lineup remain the same: the Ioniq 5, Kona Electric, and the Ioniq 6.

Top models (wholesale shipments) last month and YTD (YOY change):

- E-GMP BEVs: 12,088 (down 23%) and 179,957 YTD (up 43%)

- Hyundai Ioniq 5: 8,907 (down 14%) and 113,738 YTD (up 14%)

- Hyundai Kona Electric: 4,097 (down 27%) and 70,871 YTD (up 25%)

- Hyundai Ioniq 6: 1,871 (down 59%) and 54,824 YTD (up 270%)

The hydrogen fuel cell model — Hyundai Nexo — noted 80 units last month (down 82% year-over-year) and 4,552 YTD (down 57% year-over-year).

Genesis brand

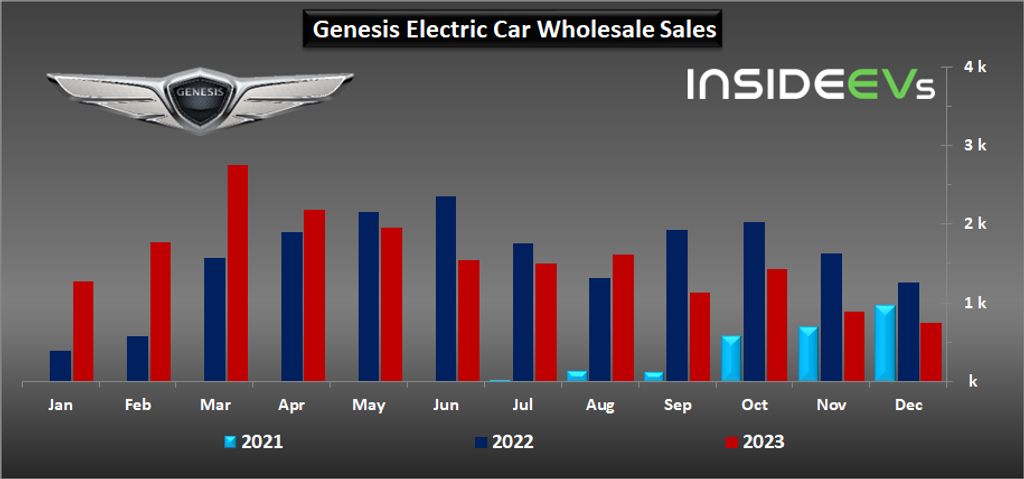

The Genesis brand continued to struggle in the all-electric car segment for the fourth consecutive month. Its wholesale shipments amounted to only 744 units, the lowest level since February 222, down 41% year-over-year. The year-to-date volume amounted to 18,759 (down 0.5% year-over-year).

2024 Targets

In 2024, Hyundai Motor intends to sell about the same number of vehicles—4,243,000, compared to 4,216,680 in 2023. This alone indicates that the year 2024 will be challenging.

There are no details related to all-electric cars, besides that profitability is one of the priorities: “Hyundai plans to take the lead in electrification and focus on optimizing profitability by strengthening its global electric vehicle (EV) production infrastructure, establishing flexible business strategies to adapt to market changes, and reinforcing preemptive risk management capabilities.”