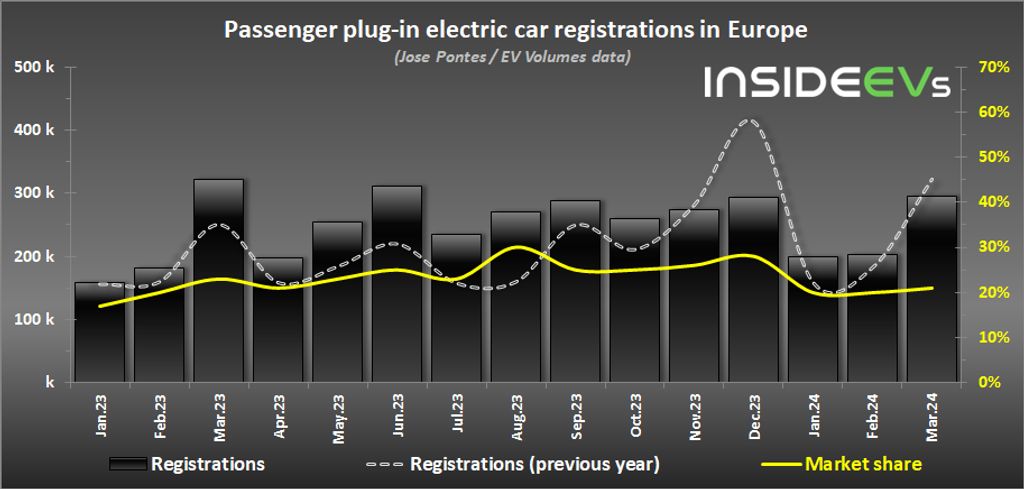

In March, plug-in electric car sales in Europe decreased by roughly 8% year-over-year, partially because March 2023 was very strong. However, the Q1 result was still about 5% better than a year ago.

According to EV Volumes data, shared by researcher Jose Pontes, 295,980 new plug-in electric cars were registered in Europe in March. The market share amounted to roughly 21% (compared to 23% a year ago).

Plug-in car sales increased in Q1

After the first quarter of 2024, the plug-in electric car sales volume increased by about 5% year-over-year. This gives hope that the year 2024 will be positive.

All-electric car registrations account for about 14% of the market (close to 200,000 units, but down about 12% year-over-year), while plug-in hybrid registrations account for about 7% of the market.

One of the most interesting things is that non-rechargeable hybrids noted a 20% sales increase and expanded their share to 30%. Electrified cars (EVs, PHEVs, and HEVs) hold a 51% share in Europe in March.

Plug-in car registrations for the month (YOY change):

- BEVs: about *197,000 and 14% market share

- PHEVs: about *99,000 and 7% market share

- Total: 295,980 (down 8%) and 21% market share

* Estimated from the market share

Over 700,000 passenger plug-in electric cars were registered in Europe during the first three months of the year, which is about 21% of the total market.

Plug-in car registrations year-to-date (YOY change):

- BEVs: about *0.43 million and 13% market share

- PHEVs: about *0.26 million and 8% market share

- Total: 701,805 (up 5%) and 21% market share

* Estimated from the market share

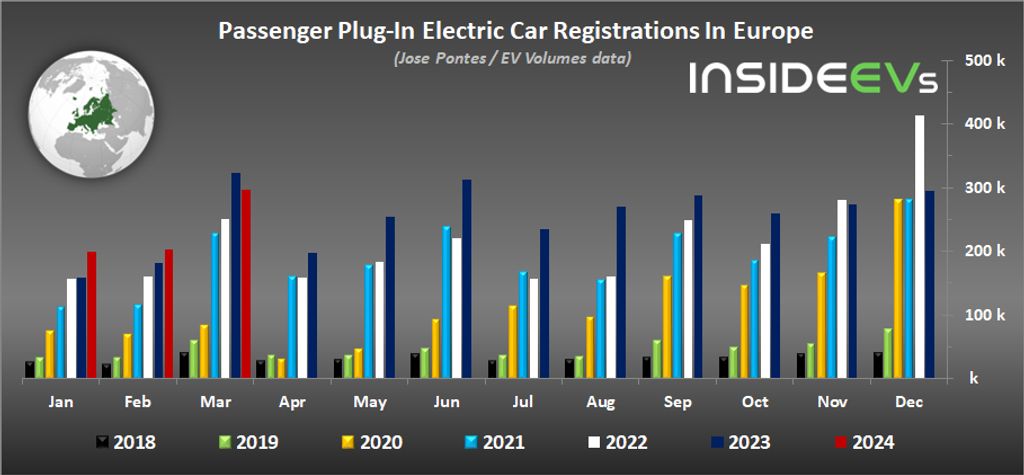

For reference, over 3 million passenger plug-in electric cars were registered in Europe in 2023, 16% more than in 2022. The market share amounted to 24% (compared to 23% in 2022, 19% in 2021, and 11% in 2020).

The Tesla Model Y remains Europe’s best-selling plug-in model, with 26,790 new registrations in March. However, the model cannot maintain its peak, and a 19% year-over-year sales decline was noted in Q1 2024.

The Tesla Model 3 is the best of the rest, with over 12,000 units. However, the star of the show in March was the all-new Volvo EX30. It surged to third position (7,642 units) in its third full month on the market.

Results for the month:

- Tesla Model Y – 26,790

- Tesla Model 3 – 12,011

- Volvo EX30 – 7,642

- Audi Q4 e-tron – 6,548

- Volvo XC60 PHEV – 5,752

- Volvo XC40 – 5,595 (5,299 BEVs + 296 PHEVs)

- Peugeot e-208 – 5,405

- BMW i4 – 5,166

- BMW iX1 – 5,018

- MG 4 – 4,772

After the first three months of the year, the two Tesla models extended their advantage over other plug-ins.

Results in January-March 2024:

- Tesla Model Y – 58,200

- Tesla Model 3 – 26,826

- Audi Q4 e-tron – 15,443

- Volvo XC40 – 15,180 (14,290 BEVs + 890 PHEVs)

- Volvo XC60 PHEV – 14,080

- Peugeot e-208 – 13,999

- Skoda Enyaq iV – 13,783

- Volvo EX30 – 13,569

- MG 4 – 13,163

- BMW i4 – 12,293

Tesla is the most popular brand in the plug-in car segment, slightly ahead of BMW and Mercedes-Benz. However, the report says that Tesla’s volume decreased 35% year-over-year in March.

In terms of automotive groups, the Volkswagen Group, with a 19.1% share, is the lone leader, followed by Tesla (12.2%) and Stellantis (12.1%).

Top brands by share in the plug-in segment in January-March:

- Tesla – 12.2%

- BMW – 10.3%

- Mercedes-Benz – 8.7%

- Volvo – 8.2%

- Audi – 7.1%

- Volkswagen – 5.1%

Top automotive groups by share in the plug-in segment in January-March:

- Volkswagen Group – 19.1%

- Tesla – 12.2%

- Stellantis – 12.1%

- BMW Group – 10.9%

- Geely-Volvo – 10.0%

- Mercedes-Benz Group – 9.2%