The European passenger car market continued its recovery in April, almost reaching one million new registrations (up 16 percent year-over-year).

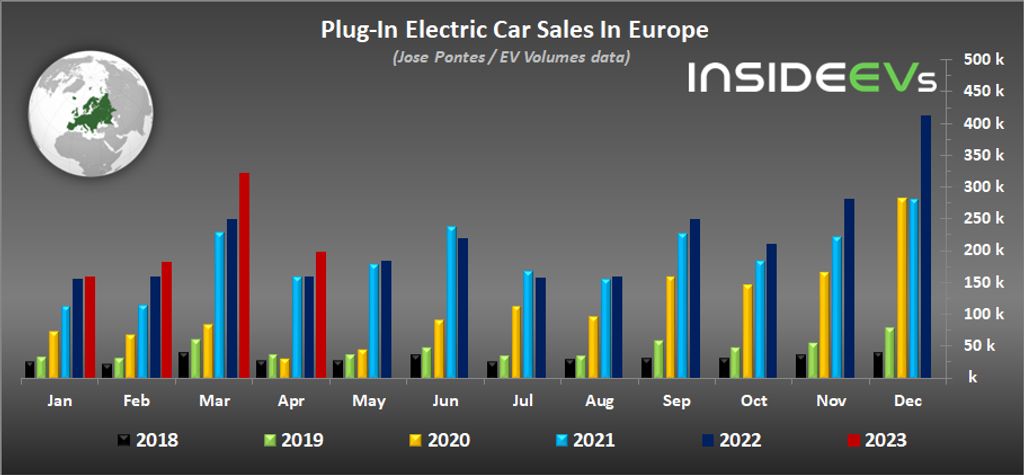

The plug-in electric car segment expanded slightly faster, gaining a bit of market share. According to EV Volumes data, shared by Jose Pontes, in April over 197,000 new plug-in electric cars were registered in Europe, which is roughly 25 percent more than a year ago. That’s also 21 percent of the total volume.

For us, an even more important thing is that the all-electric segment expanded by 50 percent year-over-year to over 120,000, taking 13 percent of the total volume. Plug-in hybrids, on the other hand, noted a 4 percent decrease.

New plug-in car registrations:

- BEVs: *122,500 (up 50% year-over-year) and 13% share

- PHEVs: *75,400 (down 4% year-over-year) and 8% share

- Total: 197,950 (up 25% year-over-year) and 21% share

* estimated from the market share

So far this year, more than 867,000 passenger plug-in electric cars were registered in Europe, which is about 20 percent more than a year ago.

New plug-in car registrations year-to-date:

- BEVs: about *0.56 million and 13% share

- PHEVs: about *0.30 million and 8% share

- Total: 867,574 (up 20% year-over-year) and 21% share

* estimated from the market share

For reference, in 2022, more than 2.6 million new passenger plug-in electric cars were registered in Europe (about 23 percent of the total volume).

The Tesla Model Y was the best-selling plug-in model in Europe in April (10,778) and for the past six consecutive months.

Next, we can see the Volkswagen ID.4 (6,682), Volvo XC40 (6,004 when counting BEVs and PHEVs together), and Volkswagen ID.3 (5,927). It’s worth noting the strong position of MEB-based models, as there is Skoda Enyaq iV (5,101) and Audi Q4 e-tron (4,991) in the top six as well.

Seventh and eighth were the all-electric MG 4 and Dacia Spring, both reminding us of the strengthening position of China-made EVs. By the way, there is no Tesla Model 3 in the top 10.

Results last month:

- Tesla Model Y – 10,778

- Volkswagen ID.4 – 6,682

- Volvo XC40 (BEV + PHEV) – 6,004

- Volkswagen ID.3 – 5,927

- Skoda Enyaq iV – 5,101

- Audi Q4 e-tron – 4,991

- MG 4 – 4,244

- Dacia Spring – 4,221

- Fiat 500 electric – 4,072

- Ford Kuga PHEV – 3,929

After the first four months, the Tesla Model Y extended its advantage over the rest of the pack. Meanwhile, the Volkswagen ID.4 appears to be getting closer to the podium with an eye on second position.

Results year-to-date:

- Tesla Model Y – 83,340

- Volvo XC40 (BEV + PHEV) – 26,993

- Volkswagen ID.3 – 23,350

- Volkswagen ID.4 – 22,881

- Tesla Model 3 – 22,703

- Audi Q4 e-tron – 20,414

- Dacia Spring – 18,507

- Fiat 500 electric – 18,268

- Peugeot e-208 – 17,158

- MG 4 – 17,004

Tesla remains the most popular plug-in car brand in Europe, by registration volume, but as an automotive group, it’s now slightly behind Stellantis (when counting BEVs and PHEVs together).

Top plug-in brands (share year-to-date):

- Tesla – 12.6%

- Volkswagen – 8.2%

- BMW – 7.7%

- Mercedes-Benz – 7.7%

- Volvo – 6.5%

- Audi – 5.4%

Top plug-in automotive groups (share year-to-date):

- Volkswagen Group – 19.6% share (Volkswagen brand at 8.2%)

- Stellantis – 13.9%

- Tesla – 12.6%

- BMW Group – 9.3% share (BMW brand at 7.7%)

- Geely–Volvo – 9.1%

- Mercedes-Benz Group (Mercedes-Benz brand at 8.6%)