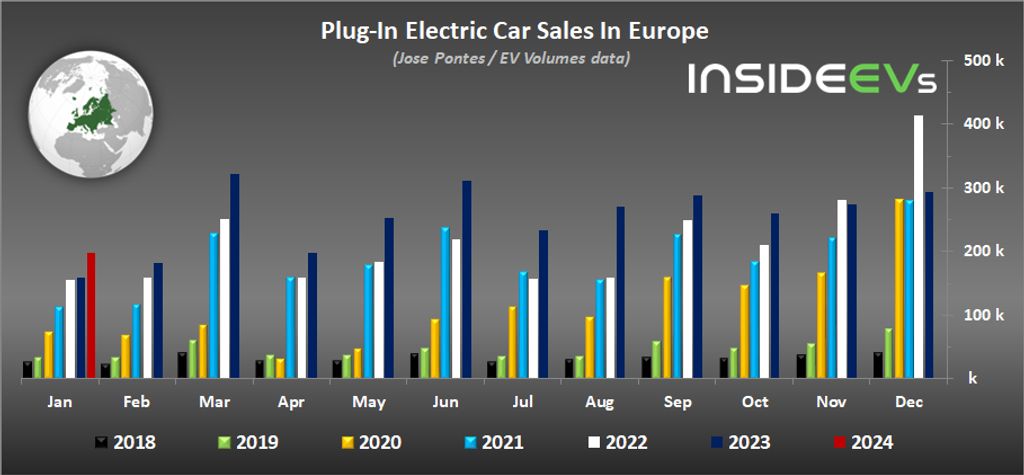

In January, plug-in electric car sales in Europe increased by roughly 25% year-over-year, which is a positive sign considering that some incentives were reduced or cut.

According to EV Volumes data shared by researcher Jose Pontes, 198,993 new plug-in electric cars were registered in Europe in January. The market share amounted to roughly 20% (compared to 17% a year ago).

Get Fully Charged

The year 2023 brought a slight increase in EV sales in Europe

In 2023, more than 3 million plug-in electric cars were sold in Europe. That’s 16% more than in 2022 and 24% of the total market.

All-electric car registrations improved by 29% year-over-year to roughly 120,000, taking 12% of the market. Plug-in hybrids were up too, by 23% year-over-year.

It will be interesting to see how the situation will develop in 2024, but we are cautiously optimistic.

Plug-in car registrations in January (YOY change):

- BEVs: about *120,500 (up 29%) and 12% market share

- PHEVs: about *78,500 (u 23%) and 8% market share

- Total: 198,993 (up 25%) and 20% market share

* Estimated from the market share

For reference, in 2023, over 3 million passenger plug-in electric cars have been registered in Europe, 16% more than in 2023. The market share amounted to 24% (compared to 23% in 2022, 19% in 2021 and 11% in 2020).

Plug-in car registrations in 2023 (YOY change):

- BEVs: about *1.84 million and 16% market share

- PHEVs: about *1.17 million up and 8% market share

- Total: 3,016,880 (up 16%) and 24% market share

* Estimated from the market share

Tesla noted a very strong start to the year, putting two of its cars at the top of the plug-in car sales list. The Tesla Model Y was Europe’s best-selling plug-in model for the 15th month in a row in January with 11,425 new registrations.

The Tesla Model 3 was the second most popular plug-in model in January (6,479 units), followed by the two MEB-based crossover/SUVs: Audi Q4 e-tron (4,979) and Skoda Enyaq iV (4,816). By the way, the Volkswagen ID.4 was outside of top 20 with 2,227 units.

Results for the month:

- Tesla Model Y – 11,425

- Tesla Model 3 – 6,479

- Audi Q4 e-tron – 4,979

- Skoda Enyaq iV – 4,816

- Volvo XC40 – 4,554 (4,371 BEVs + 183 PHEVs)

- Volvo XC60 PHEVs – 4,075

- MG 4 – 3,544

- Ford Kuga PHEV – 3,496

- BMW i4 – 3,473

- Dacia Spring – 3,409

For reference, below we attached the list of the top models in 2023.

Results in January-December 2023:

- Tesla Model Y – 255,062

- Tesla Model 3 – 101,313

- Volkswagen ID.4 – 83,033

- Skoda Enyaq iV – 78,739

- Volvo XC40 – 73,650 (50,839 BEVs + 22,811 PHEVs)

- MG 4 – 72,421

- Audi Q4 e-tron – 69,529

- Fiat 500 electric – 64,579

- Volkswagen ID.3 – 63,475

- Dacia Spring – 59,331

The start of the year brought us a slightly unusual list of top plug-in car brands and OEMs, as BMW became the #1 with a 10.3% share in the rechargeable car segment. Tesla was second best with 9.1%, but only slightly ahead of another German premium brand—Mercedes-Benz.

In terms of automotive groups, the Volkswagen Group with 20.5% share is a lone leader, significantly ahead of Stellantis (12.0%).

Top brands by share in the plug-in segment in January:

- BMW – 10.3%

- Tesla – 9.1%

- Mercedes-Benz – 9.0%

- Audi – 8.3%

- Volvo – 7.8%

- Volkswagen – 5%

- Kia – 5%

- Peugeot – 4.8%

Top automotive groups by share in the plug-in segment in January:

- Volkswagen Group – 20.5% share (Volkswagen brand at 5%)

- Stellantis – 12.0%

- BMW Group – 11.0% share (BMW brand at 10.3%)

- Geely-Volvo – 9.6%

- Mercedes-Benz Group – 9.5% (Mercedes-Benz brand at 9.0%)

- Tesla – 9.1%

- Hyundai Motor Group – 8.7%