The global passenger xEV (BEVs, PHEVs, HEVs) battery market continued to expand quickly in 2023, partially thanks to record vehicle sales and partially because the average battery capacity is increasing.

According to Adamas Intelligence in 2023, about 689.2 gigawatt-hours (GWh) of battery capacity was deployed onto roads globally in all newly sold passenger xEVs. That’s about 40% more than a year ago, the company estimates.

Get Fully Charged

690 GWh of batteries in 2023

One gigawatt-hour (GWh) of battery capacity is 1,000 megawatt-hours (MWh) or 1,000,000 kilowatt-hours (kWh). 690 GWh deployed in 2023 means that on average, almost 1.9 GWh was deployed each day—that’s equivalent to almost 19,000 battery packs (100 kWh each).

Let’s recall that passenger plug-in electric car registrations increased in 2023 by 35% year-over-year to almost 13.7 million units. All-electric cars represent the highest share of battery deployment, followed by plug-in hybrids. Non-rechargeable hybrids are also contributing to the total number, but to a smaller degree because their battery packs are usually relatively small.

We do not expect the battery market to slow down but rather continue its growth towards higher records. However, it’s not certain that we will see a 1 terawatt-hour (TWh) level (1,000 GWh) this year.

Battery capacity deployed onto roads globally (newly sold passenger xEVs):

Adamas Intelligence also noted that the 2023 volume alone is worth 37% of all battery capacity ever deployed. 2023’s 690 GWh is more than the volume deployed in eight years, from 2014 and 2021 combined.

Top brands

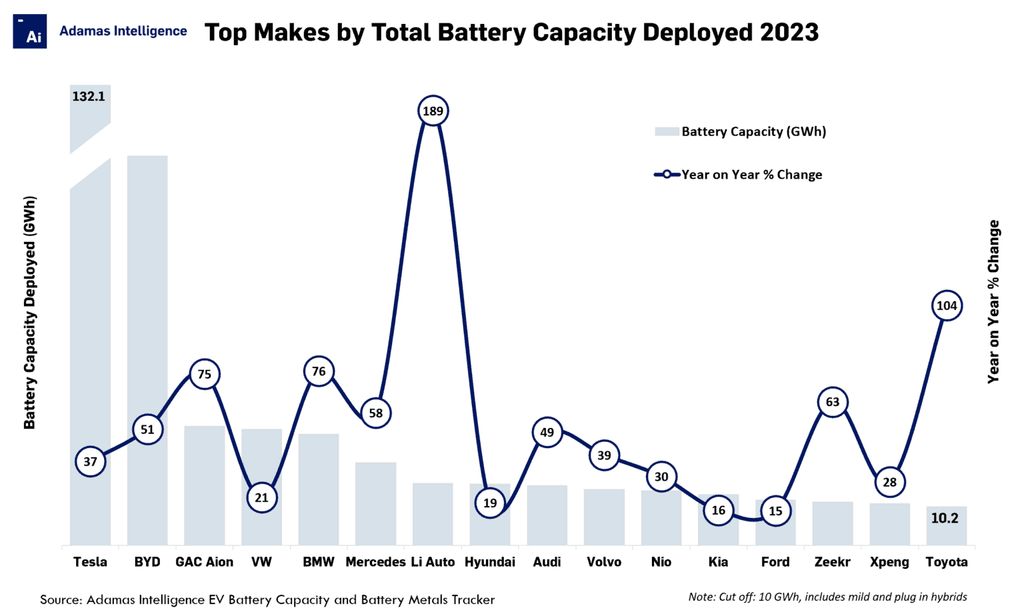

While close to 200 brands contributed to the total result, only 16 managed to exceed 10 GWh, while two—Tesla and BYD—were above 100 GWh.

Tesla deployed 132.1 GWh of batteries, according to the report, 37% more than a year ago. BYD achieved 101.6 GWh (up 51% year-over-year), despite selling more cars (3 million units) because it’s heavy on plug-in hybrids (about half of the volume).

The China-focused GAC Aion was the best of the rest with 31.1 GWh (up 75%), slightly ahead of Volkswagen, which deployed 30.3 GWh (up 21%). BMW was fifth with 29.1 GWh (up 76%).

It’s worth noting that the wider Volkswagen Group, with all its brands, exceeded 50 GWh in 2023, so it seems that it was the third top automotive group.

Top brands (year-over-year change):

- Tesla: 132.1 GWh (up 37%)

- BYD: 101.6 GWh (up 51%)

- GAC Aion: 31.1 GWh (up 75%)

- Volkswagen: 30.3 GWh (up 21%)

- BMW: 29.1 GWh (up 76%)

- Mercedes-Benz: (up 58%)

- Li Auto: (up 189%)

- Hyundai: (up 19%)

- Audi: (up 49%)

- Volvo: (up 39%)

- NIO: (up 30%)

- Kia: (up 16%)

- Ford: (up 15%)

- Zeekr: (up 63%)

- XPeng: (up 28%)

- Toyota: 10.2 GWh (up 104%)

In terms of the growth rate, the Chinese Li Auto almost tripled its battery deployment, by selling a lot of extended-range electric vehicles (EREV). Toyota is also starting to take off, more than doubling its result in 2023. The Japanese company might do it again in 2024, and leapfrog some smaller brands.