DETROIT — Lithium iron phosphate battery supplier Our Next Energy said it has extended the range of its electric vehicle batteries, making them competitive with the range of more expensive nickel manganese cobalt cells.

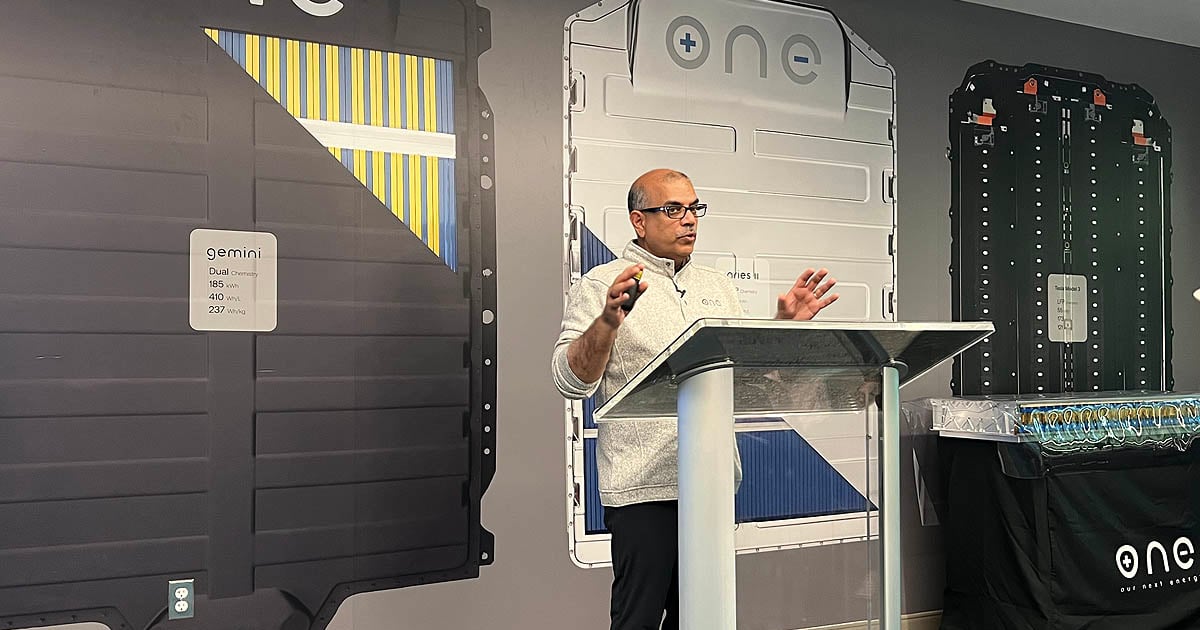

The company has hit its goal of a 350-mile range on a typical EV using its Aries II LFP battery, designed for passenger vehicles. The range boost, up from 250 miles in the previous iteration of Aries II, makes the battery comparable with most nickel manganese cobalt batteries that power EVs, CEO Mujeeb Ijaz said Tuesday at an Automotive Press Association event at Our Next Energy’s headquarters in Novi, Mich.

NMC cells have been popular among automakers and battery suppliers because they typically provide a longer range, but nickel and cobalt are expensive and difficult to source. Iron is widely available and costs less. Our Next Energy said its LFP cell is 25 percent less expensive to manufacture than comparable NMC batteries, the company said.

Our Next Energy, known as ONE, said it has also reduced the weight of its battery to within 6 percent of a comparable NMC battery. Typically, LFPs are about 265 poiunds heavier than NMC batteries with a similar range.

ONE has long worked to maximize energy density in the cell. Now, the company is also enhancing battery pack architecture to cut weight.

“That is the enclosure, battery management, structure. It’s everything that is not cell that we’ve been able to further optimize,” Ijaz told Automotive News.

ONE will begin producing batteries for commercial vehicles and battery storage late next year at its plant in Van Buren Township, Mich. It plans to launch the Aries II for passenger vehicles in 2025, followed by the 600-mile-range Gemini in 2026. The company expects its batteries to comply with the Inflation Reduction Act, making the buyers of vehicles that use them eligible for significant federal income tax credits.

Our Next Energy will likely build the Aries II at a second plant. Ijaz said he expects to share details on that plant this year. The company is in discussions with suppliers to co-locate on new sites to localize the battery supply chain, he said.

Iron and manganese were obvious battery material choices for the company when it was founded in 2020 because they can be mined and processed in North America, Ijaz said.

The industry “is about to birth an entire supply chain in North America. To me, it would be ideal to birth the supply chain with the right materials,” he said.

ONE and BMW partnered last year on the long-range Gemini battery to power the BMW iX. The company is in discussions with other automakers for the Aries II, Ijaz said.

Ijaz’s pitch to automakers centers on eliminating nickel and cobalt, which are expensive. Batteries using those materials are more susceptible to fire than the iron phosphate chemistry.

“We could help automotive companies achieve the same range that they’re getting today, avoiding those two risks and at a lower price,” he said. “And then we can offer a way to double that range. As we go after 600 miles of range, we are uniquely differentiated in that offering right now.”