The nation’s transition to EVs is fracturing by region. While EV purchases are rising overall, adoption is declining in the states that already had the lowest rates, according to J.D. Power.

Nationwide, 21 percent of consumers who have an EV option that matched their model preference purchased an EV in the first half of this year, compared with 20 percent a year earlier, according to J.D. Power’s August E-Vision report.

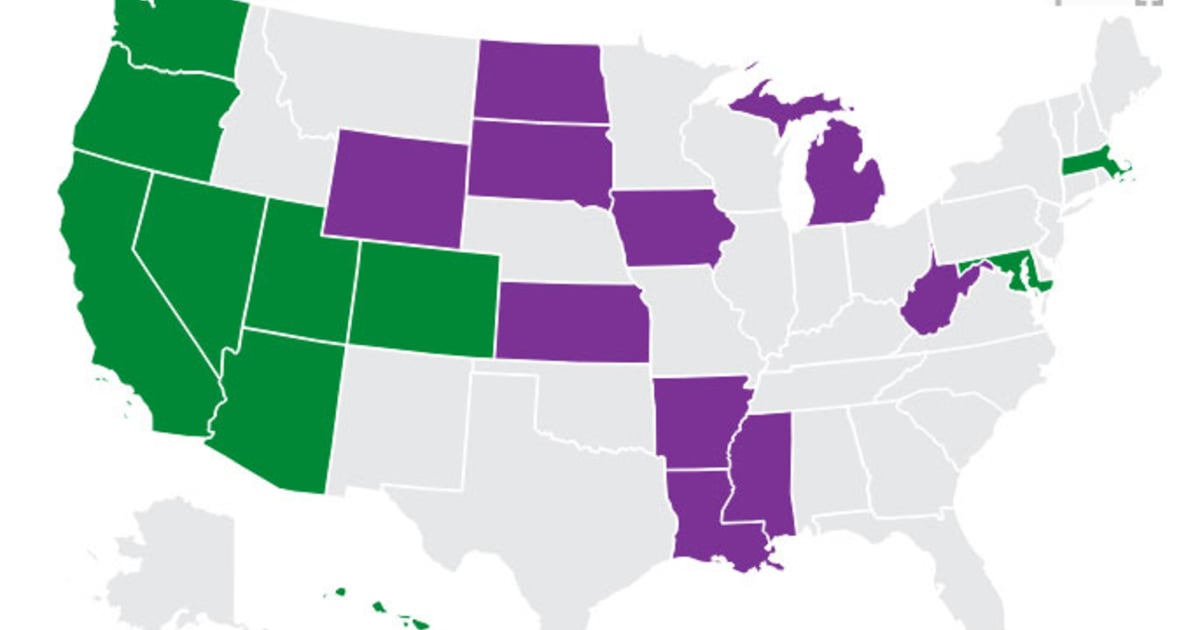

But at the state level, there is a glaring division between EV-friendly and EV-lagging states. In the bottom 10 states for EVs, the pace of adoption sunk 24 percent from a year earlier. In the top 10 states, pace of adoption grew 1 percent.

(J.D. Power divides EV retail share by market availability to calculate adoption. Availability measures whether an EV exists at the price and size consumers want and from their preferred brand.)

EV share is growing overall. Battery-electric sales made up 8.6 percent of retail share nationwide in June, compared with 5.7 percent a year earlier, according to J.D. Power.

States that invest in EV charging infrastructure and offer incentives have higher adoption rates, Elizabeth Krear, vice president of the practice at J.D. Power, told Automotive News.

Six of the top states J.D. Power ranked for EV adoption overlap with states that had the most policies for scaling deployment of EVs and building charging infrastructure, according to a July scorecard by the American Council for an Energy-Efficient Economy. Those states are California, Colorado, Massachusetts, Washington, Oregon and Maryland. The council’s State Transportation Electrification Scorecard found that southern states that have been recipients of some of the biggest EV and battery investments lag in policies that encourage EV adoption.

Ten states have incentives on top of federal spiffs, according to J.D. Power. Four of those 10 — California, Colorado, Massachusetts and Maryland — are among the states with the highest EV adoption rates.

The overlaps show the impact of state policy on EV adoption.

J.D. Power expects the state-by-state divide to continue over the next decade. By 2035, the firm expects the U.S. to reach 70 percent EV retail share. EV share in California, today’s EV leader, will hit 94 percent, while North Dakota, which has the lowest EV adoption rate today, will reach 19 percent, J.D. Power said.

Charging infrastructure in California drastically eclipses infrastructure in North Dakota. California has 14,976 charging stations with 40,370 ports as of Sept. 1, according to the Department of Energy’s Alternative Fuels Data Center. North Dakota has just a sliver of that at 88 charging stations with 187 ports.

Rachel Goldstein, a research and modeling manager at the nonpartisan energey and environmental policy firm Energy Innovation, expects federal funding to help expand EV adoption nationwide. Adoption declining in certain states today isn’t an indicator for EV adoption long term, she said.

In states that have strong incentives and no EV ownership fees, consumers’ cost of ownership will be lower for EVs than comparable gasoline vehicles, she said. For now, leasing an EV is the most affordable way to get a new car, according to an August report from Energy Innovation.

As EV adoption grows in the top states, the rest of the country will follow, Goldstein said.

“As states in earnest start taking those federal dollars and building up infrastructure, people will start to feel more secure in their options for charging vehicles and having less range anxiety,” she said. “That’s going to be pretty important, especially in these low adoption states.”

But in some states, an EV that’s comparable to a consumer’s gasoline vehicle is nonexistent, driving down the adoption rate, J.D. Power said. Many residents in low adoption states purchase full-size pickups at relatively low price points. Today’s EV market doesn’t include a pickup within their price range, Krear said. The least-expensive electric pickup on the market is the Ford F-150 Lightning at $51,990 including shipping. That compares with the gasoline version, which starts at $35,830, including shipping.

In other states, such as New York and Texas, consumers can more readily find an EV in their preferred segment and in their higher price range.

EV affordability improved in the first half of this year, largely because of Tesla’s price cuts, J.D. Power said. Tesla’s average transaction price in June fell 18 percent from a year earlier to $55,106, according to Cox Automotive. But J.D. Power expects the average EV price to shoot up as automakers release new models, especially halo EVs that often come with a six-digit price tag. The electric Cadillac Escalade IQ starts at $130,000 with shipping.

About 80 percent of EV sales through July were in the premium segment, Krear said, and 65 percent of them were Teslas. Premium sales account for only 15 percent of gasoline vehicles retailed.

“That’s why Tesla reducing pricing to gain market share is so critical and is pulling that affordability score up,” Krear said. “They’ve got pricing power right now.”

In high-volume segments, such as midsize and compact SUVs and large pickups, EV price parity with combustion engine vehicles is still out of reach, Krear said.

“To advance mass market adoption, the industry needs more mass-market availability at lower prices,” Krear said.

J.D. Power expects 65 percent of consumers to have a EV option that fits their model preferences by 2025. That will grow to 80 percent a year later.

“Availability will be there. Will infrastructure be there? Will incentives still be there? If incentives are not there, what will the pricing situation be?” Krear said. “We need to keep an eye on all of it.”