Amid a growing U.S. EV market, both the average price of a Tesla and the automaker’s market share decreased substantially in the third quarter of 2023, new data from Kelley Blue Book shows.

EV transaction prices were down overall in Q3. In September, the average price paid for an EV was $50,683, down from $52,212 in August and down from more than $65,000 one year ago.

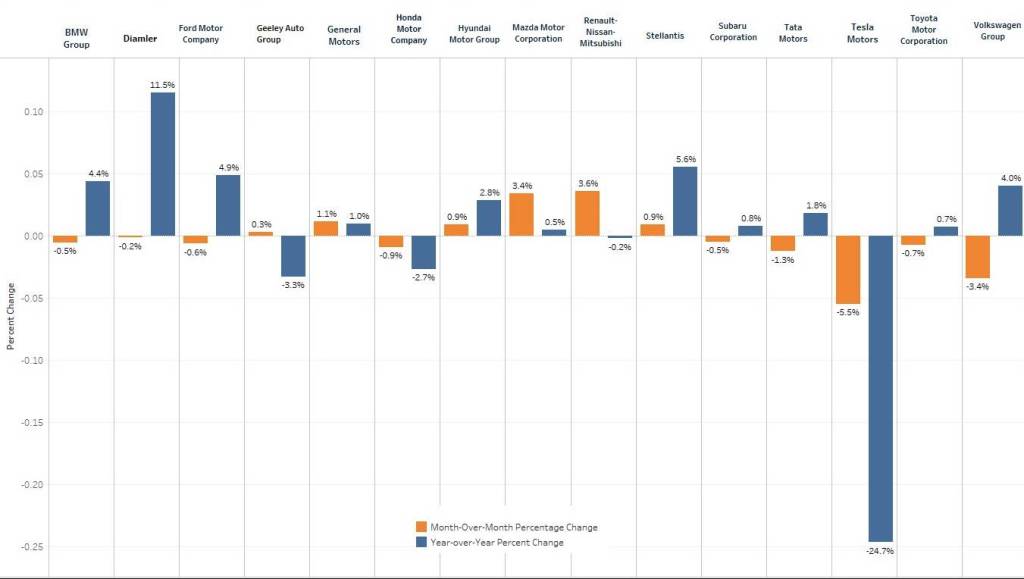

However, Tesla prices declined at a much steeper rate than other brands. In an effort to boost sales, Tesla cut prices to the point where they are now down 25% year over year. And it just announced more price cuts for the Model 3 and Model Y earlier this month.

EV price change percentage by automaker for Q3 2023 (via Kelley Blue Book)

The price cuts did seem to help, as Tesla’s Q3 sales increased 19.5% year over year, beating the industry average of 16.3% year over year growth. However, Tesla’s share of the EV market shrank to 50% in Q3, down from 62% in Q1 and the lowest ever recorded.

Tesla lost market share while increasing sales because the overall EV market has grown. Quarterly U.S. sales surpassed 300,000 vehicles for the first time, while year-to-date sales through September reached 873,000 vehicles, putting the market “firmly on track” to surpass one million sales for the first time ever this year, according to KBB, noting that Tesla “remains the undisputed leader in EV sales.”

Tesla Supercharger

Tesla last month reported that it had made 5 million EVs globally, the most of any automaker, while California just earlier last year accounted for one-eighth of Tesla’s global deliveries. In comparison, Ford has the second-highest U.S. EV sales total at 20,000 vehicles. Other automakers—Porsche, Mercedes, Volkswagen, Volvo, Audi, and BMW—have surpassed 10% EV sales, but that still translates to small numbers of vehicles.

Tesla has been losing EV market share for years but gaining share versus luxury brands. Now that most of those luxury brands have a wide range of EVs, the trend appears to be reversing.