The Volkswagen Group (which includes Volkswagen, Audi, Porsche, Skoda, Seat, Cupra, and more) reports 2,104,300 global vehicle sales during the first quarter of 2024 (up 3.1% year-over-year).

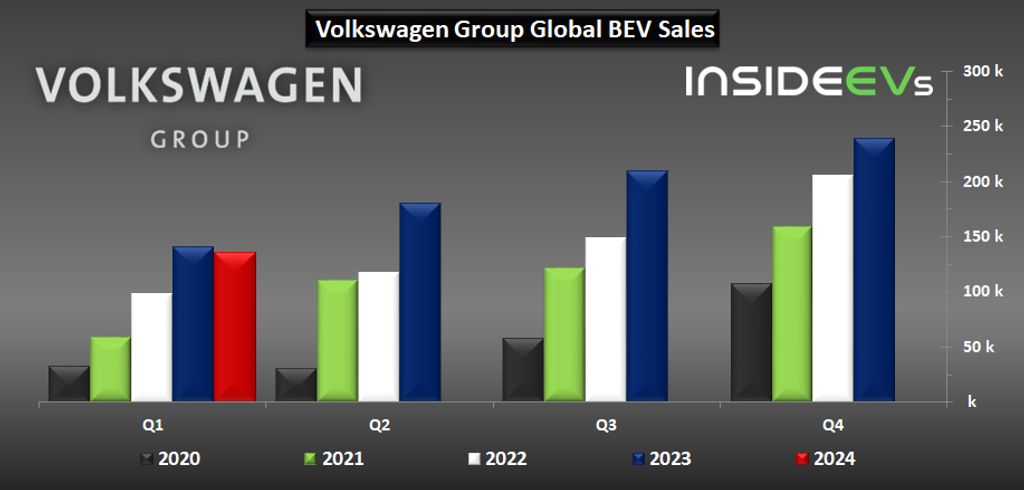

However, in the all-electric segment, the group noted a slight decline. In Q1, Volkswagen Group’s all-electric vehicle sales amounted to about 136,400 (down 3.3% year-over-year). EVs accounted for 6.5% of the total volume, compared to 6.9% a year ago.

Volkswagen Group BEV sales increases

In 2023, the total Volkswagen Group all-electric vehicle sales exceeded 771,000, almost 35% more than in 2022. This year, the growth is still on the table, but it will be much more challenging to achieve.

The German manufacturer says that incoming EV orders in Western Europe more than doubled in Q1 (up 154% year-over-year), which is expected to boost sales in the near future. As of early April, the EV order bank stands at around 160,000 vehicles, the company said.

Volkswagen Group BEV sales in Q1’2024 (YOY change):

- Total: 136,400 (down 3.3%) and 6.5% share

For reference, in 2023, the group sold more than 771,000 all-electric vehicles around the world—35% more than in 2022, achieving a new record BEV share of 8.3%.

Volkswagen Group BEV sales in Q1-Q4’2023 (YOY change):

- Total: 771,100 (up 35%) and 8.3% share

The recent results are disappointing, as Volkswagen Group’s growth was already lagging behind some other large automotive groups in 2022 and 2023. It seems that the year 2024 is much more challenging.

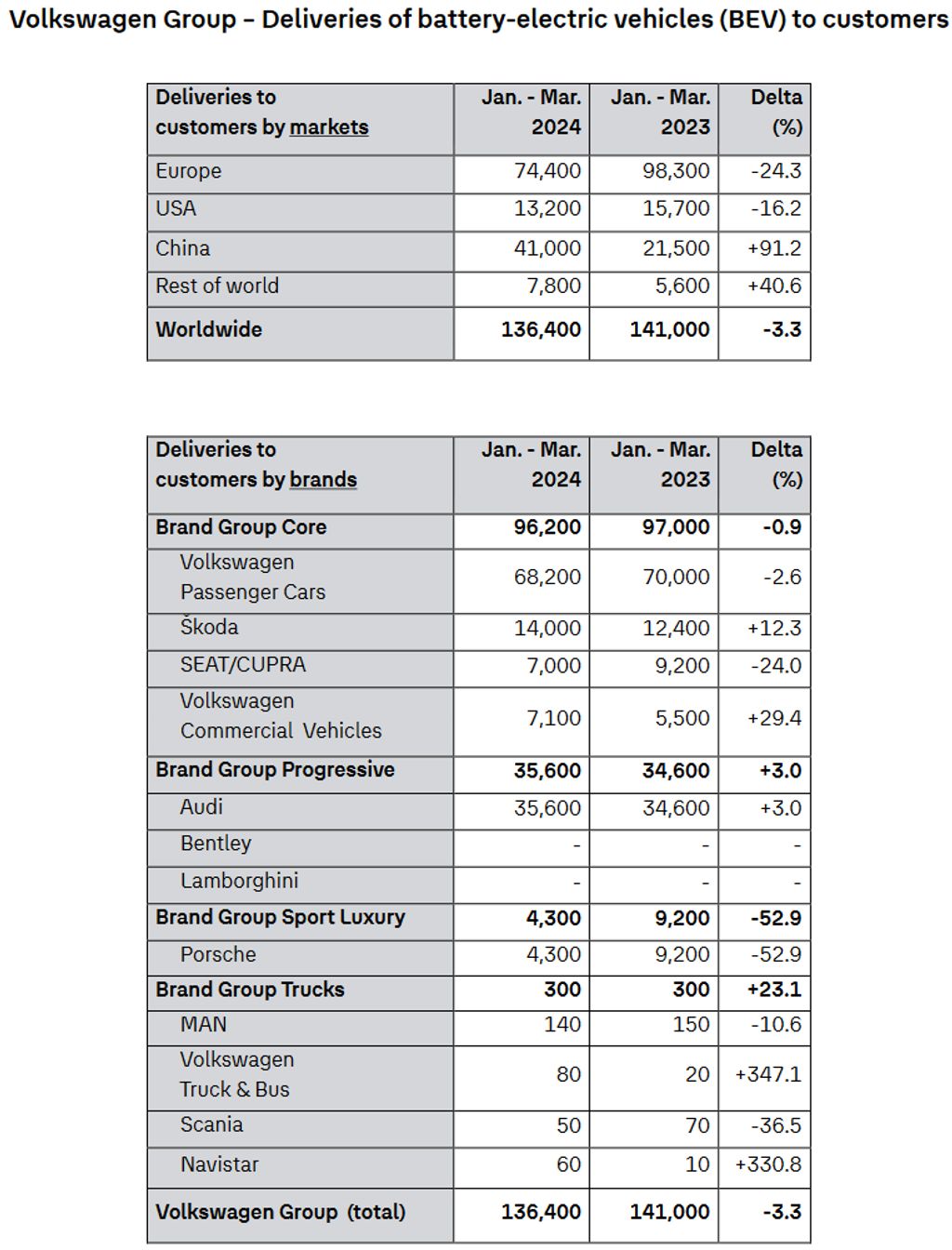

Europe remains the largest EV market for the Volkswagen Group (more than half of all sales), but in Q1 the volume decreased by almost one-fourth.

The second largest market is China, which noted a strong 91% year-over-year increase.

BEV sales in Q1’2024 (YOY change):

- Europe: 74,400 (down 24.3%) and 54.5% share

- U.S.: 13,200 (down 16%)

- China: 41,000 (up 91%)

- Rest of the world: 7,800 (up 41%)

- Total: 136,400 (down 3.3%)

Regarding all-electric vehicle sales, the Volkswagen brand was the largest one with 68,200 units sold in Q1, although it noted a slight year-over-year decline. Porsche and Seat/Cupra noted the biggest decrease of 54% and 24%, respectively.

Sales in Q1’2024 (YOY change):

- Volkswagen (cars): 68,200 (down 2.6%)

- Audi: 35,600 (up 3.0%)

- Skoda: 14,000 (up 12.3%)

- Volkswagen Commercial Vehicles: 7,100 (up 29%)

- Seat/Cupra: 7,000 (down 24%)

- Porsche: 4,236 (down 54%)

- other (MAN, Volkswagen Truck & Bus, Scania, Navistar): 330 (up by about 32%)

- Total: 136,400 (down 3.3%)

Once again, without any surprise, the Volkswagen ID.4 (counted by the manufacturer together with the ID.5 coupe version) and the Volkswagen ID.3 continued to be the best-selling models within the group.

Select BEV model sales (for which data are available) in Q1’2024:

- Volkswagen ID.4/ID.5 – 34,600

- Volkswagen ID.3 – 26,100

- Audi Q4 e-tron (incl. Sportback) – 22,800

- Skoda Enyaq iV (incl. Coupé) – 14,000

- Audi Q8 e-tron (incl. Sportback) – 9,600

- Volkswagen ID. Buzz – 7,000

- Cupra Born – 6,900

- Porsche Taycan (all versions) – 4,236

- other models – 11,164

- Total: 136,400 (down 3.3%)

Some of the models are very similar and offered by different brands. We can distinguish two groups, which when counted together, have a dominant share in the overall result:

- MEB-based hatchbacks: 33,000 (24% of all BEVs)

Volkswagen ID.3 and Cupra Born - MEB-based crossover/SUVs: 71,400 (52% of all BEVs)

Volkswagen ID.4/ID.5, Audi Q4 e-tron (incl. Sportback) and Skoda Enyaq iV (incl. Coupé) - all other models combined: 32,000 (23% of all BEVs)

In 2024, the Volkswagen Group intends to launch several new all-electric models, including the Volkswagen ID.7 Tourer (estate version of the ID.7), the Volkswagen ID. Buzz with a long wheelbase (LWB), Cupra Tavascan (another cousin of the ID.4), and the two first models based on the all-new Premium Platform Electric (PPE) system: Audi Q6 e-tron and the Porsche e-Macan.